DREAM FINDERS HOMES, INC.

14701 Philips Highway, Suite 300

Jacksonville, Florida 32256

November 24, 2020

BY EDGAR

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Division of Corporation Finance

Attention: Ronald E. Alper

RE: Dream Finders Homes, Inc.

Registration

Statement on Form S-1

Confidentially

Submitted October 13, 2020

CIK

No. 0001825088

Dear Mr. Alper:

On behalf of Dream Finders Homes, Inc. (the “Company”), enclosed is a copy of Confidential Draft Submission No. 2 (“Submission No. 2”) of the Company’s Registration Statement on Form

S-1 (the “Registration Statement”) that was confidentially submitted today via EDGAR, marked to show changes made to the original confidential draft of the Registration Statement submitted to the Securities and Exchange Commission (the “Commission”)

on October 13, 2020. The changes reflected in Submission No. 2 include those made in response to the comments of the staff of the Division of Corporation Finance of the Commission (the “Staff”) set forth in the Staff’s letter dated November

9, 2020.

Set forth below are the Company’s responses to the Staff’s comments. The Company’s responses below are preceded by the Staff’s comments for ease of reference. Capitalized terms used but not defined

herein have the meanings given to them in the Submission No. 2.

Draft Registration Statement on Form S-1 filed October 13, 2020

Non-GAAP Financial Measures, page 69

| 1. |

We note your non-GAAP measure of “adjusted gross margin.” In this measure, we note the adjustment for commission expense. Please further clarify why you believe isolating the impact of commission expense and

adjusting for it in arriving at adjusted gross margin is meaningful to an investor. Please revise to update your disclosure, as applicable. Reference is made to Item 10(e)(1)(i)(C) of Regulation S-K.

|

RESPONSE: The Company believes that it is appropriate to exclude commission expense from its adjusted gross margin in order to provide investors with a meaningful comparison to the public

company homebuilders (as defined in Submission No. 2). Based on a review of the Commission filings by the public company homebuilders, we believe a substantial majority of the public company homebuilders (other than NVR, Inc.) include commission

expense below the gross margin line in selling, general and administrative expenses (SG&A). NVR, Inc. similarly includes commission expense in cost of sales, not SG&A, and thus it is taken into account in gross margin. The Company believes

that if commission expense was not excluded in its adjusted gross margin, then investors would be provided with a much less meaningful comparison to other public company homebuilders. The Company has added disclosure on pages 21 and 69 of Submission

No. 2 explaining why it believes that excluding commission expense from its adjusted gross margin is meaningful to an investor.

United States Securities and Exchange Commission

Page 2

Page 2

Management’s Discussion and Analysis

Off Balance Sheet Arrangements, page 95

| 2. |

We note your disclosure stating there were $31.1 million in deposits paid for your finished lot and land bank option contracts as of June 30, 2020. Please reconcile this amount to your balance sheet of the same

date, which reports lot deposits of $24.6 million. Please revise your disclosure to provide further clarity, as needed.

|

RESPONSE: The Company believes that it is appropriate to disclose all cash paid and invested to control lots, including refundable and non-refundable lot deposits in finished lot and land bank

option contracts as reported on the face of the Company’s balance sheet, investments in joint ventures (which also own lots), and deposits in unconsolidated equity method investments (some of which also own lots and/or provide land bank financing).

As a result, the Company has provided additional disclosure as of September 30, 2020 to reconcile its full deposit balance of $39.1 million to the lot deposits balance on the face of the Company’s balance sheet of $32.7 million. As of September 30,

2020, the Company has placed deposits and made investments of $39.1 million, including: (1) $32.7 million of refundable and non-refundable lot deposits in finished lot and land bank option contracts as reported on the face of the Company’s balance

sheet; (2) $5.9 million of investments in joint ventures, which are fully eliminated in consolidation ($2.3 million of which are in investments in joint ventures with the DF Residential I, LP, and which joint ventures also own lots and some of which

provide land bank financing); and (3) $0.6 million of investments in unconsolidated equity method investments (which also own lots and some of which provide land bank financing), which are included within the Company’s non-controlling interests on

the face of the Company’s balance sheet. The Company believes that disclosing the total cash amount of $39.1 million is meaningful to investors. The Company has added disclosure on page 96 of Submission No. 2 explaining and reconciling the two

amounts, which have been updated for lots controlled as of September 30, 2020.

Business

Customer Relations, Quality Control and Warranty Program, page 144

| 3. |

Please expand the disclosure related to your monitoring program for subcontractors, including whether you have a formal monitoring program and how you ensure that your standards are met.

|

RESPONSE: In response to the Staff’s comment, the Company has added disclosure on page 144 in Submission No. 2 to expand the disclosure related to its monitoring program for subcontractors. As background, in connection with the Company’s on-boarding process with any vendor or subcontractor, the Company requires the party to execute its standard terms agreement, which includes, among other provisions,

work quality standards. The Company’s on-boarding process also requires all vendors and subcontractors to provide proof of insurance, including liability insurance and workers compensation insurance, and include the Company as an additional insured

under such policies. The quality and workmanship of the Company’s subcontractors are monitored in the ordinary course of business by the Company’s superintendents and project managers, and the Company does regular inspections and evaluations of its

subcontractors to seek to ensure that its standards are being met. In addition, local governing authorities in all of the Company’s markets require the homes the Company builds to pass a variety of inspections at various stages of construction,

including a final inspection in which a certificate of occupancy, or its jurisdictional equivalent, is issued.

| 4. |

You state that you “are constantly striving to earn a 100% willingness to refer rate” in each of your markets. Please disclose your actual willingness to refer rate for the periods in which it was measured.

|

RESPONSE: In response to the Staff’s comment, the Company has expanded the disclosure on page 144 in Submission

No. 2 to provide its actual willingness to refer rates for each of the nine months ended September 30, 2020 and the years ended December 31, 2019 and 2018, and the average willingness to refer rate for the six year period ended December 31, 2019.

The Company began measuring willingness to refer in 2014.

1 The joint ventures in clause (2) and the investments in clause (3) above own lots and some

of them provide land bank financing to the Company.

United States Securities and Exchange Commission

Page 3

Page 3

Executive Compensation

Special Bonus, page 159

| 5. |

We note your disclosure that your Board of Directors is expected to approve a special bonus for Mr. Zalupski that will be payable upon the completion of this offering. Given the potential conflict of interest

that this represents, please add a risk factor.

|

RESPONSE: In response to the Staff’s comment, the Company has added a risk factor to discuss the potential conflict of interest on page 50 of Submission No. 2.

1. Nature of Business and Significant Accounting Policies

Inventories, page F-12

| 6. |

We note your disclosure stating you periodically review the performance and outlook of your inventory for indicators of potential impairment and you have no impairment reported during the periods presented.

Please tell us and expand your inventory impairment disclosures to discuss more detailed aspects about your impairment analysis. Such expanded discussion should include aspects such as frequency (i.e., quarterly) and level (i.e., community)

in which you perform impairment analysis, the potential impairment indicators you look for, and the key assumptions utilized in your impairment analysis to determine whether impairment exists.

|

RESPONSE: In response to the Staff’s comment, the Company has expanded the disclosure on page F-12 in Submission No. 2 to provide a more detailed

discussion of its inventory impairment analysis. As background, inventories are carried at the lower of accumulated cost or net realizable value. The Company periodically reviews the performance and outlook of its inventories for indicators of

potential impairment on a quarterly basis at the community level. In addition to considering market and economic conditions, the Company assesses current sales absorption levels and recent sales profitability. In particular, the Company looks for

instances where the sales price for a home in backlog or the potential sales price for a home to be sold in the future would result in a negative gross margin. No impairments were recognized during the nine months ended September 30, 2020 (unaudited)

or during 2019 or 2018.

13. Segment Reporting, page F-31

| 7. |

We note your disclosure stating that the revenues of each remaining operating segment were not material and are classified in the “Other” category. Please tell us how you have addressed all quantitative

thresholds in accordance with ASC 280-10-50-12.

|

RESPONSE: The Company implemented ASC 280 – Segment Reporting in August 2020 in conjunction with the preparation of the Registration Statement. The Company adopted the standard as of the

period ended June 30, 2020 as it prepared to meet public company reporting requirements. In defining the Company’s operating segments and determining which operating segments are reportable segments, the Company reviewed the technical accounting

literature in ASC 280.

The Company’s chief operating decision maker is its Chief Executive Officer, Mr. Zalupski. Mr. Zalupski regularly reviews the financial results of the Company’s operating segments, which are

segregated by geographic region.

The homebuilding sector is seasonal as families generally purchase to-be-built homes in the first half of the year with the intent to move into their new homes before the next school year. As a

result of this seasonality, the Total Assets, Revenues and Net Income of the Company’s operating segments fluctuate quarter to quarter. In order to determine which segments to individually report as of June 30, 2020 and September 30, 2020, the

Company evaluated each quantitative metric in line with the 10% tests in ASC 280-10-50-10 in the tables below. The Company also assessed which of its divisions would meet the 10% thresholds at December 31, 2020, based on the seasonality of its

business.

United States Securities and Exchange Commission

Page 4

Page 4

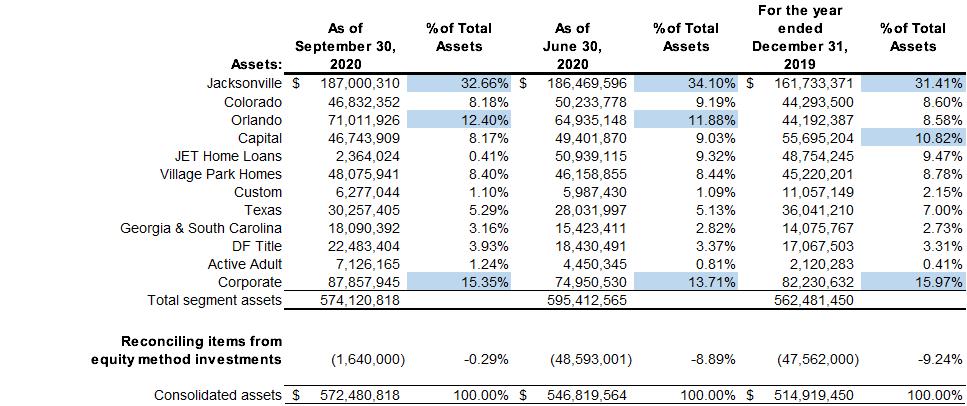

Quantitative Threshold Assessment Tables

Consolidated Assets as of September 30, 2020, June 30, 2020 and December 31, 2019 (unaudited)

The Company has evaluated its corporate division and determined that it does not meet the definition of an operating segment because it serves only as an

internal functional support division and earns no revenues, internal or external.

Consolidated Revenues for the periods ended September 30, 2020, June 30, 2020 and December 31, 2019 (unaudited)

In the aggregate, the Company individually reported operating units exceed 75% of revenue.

United States Securities and Exchange Commission

Page 5

Page 5

Consolidated Net and Comprehensive income for the periods ended September 30, 2020, June 30, 2020 and December 31, 2019 (unaudited)

As Texas is no longer in a loss position and remains a segment below 10% as of June 30, 2020 and September 30, 2020, the Company determined that aggregating Texas into the other category is

appropriate. The Company also noted that Active Adult is a new segment, with the first home sales and closings in 2020. The Company noted that as of September 30, 2020 and June 30, 2020 Active Adult was in a loss position. The Company believes the

division will be profitable by year-end as it has 12 closings scheduled in the fourth quarter of 2020, which should eliminate the loss. Finally, the Company noted that Georgia and South Carolina had an immaterial loss for the nine months ended

September 30, 2020. The Company believes that this loss will be eliminated by year-end and did not believe reporting the division separately increased the transparency of its disclosures or enhanced an investor’s understanding of the Company’s

business.

The Company also noted that Village Park Homes (“VPH”) is close to the 10% quantitative metric in certain periods for Revenue and Total Assets, but never crossed the quantitative thresholds

because the Company believes that VPH will become a smaller portion of the business in future periods and the Company elected not to disclose the operating segment individually as a reportable segment. The acquisition of H&H Homes, which was

completed on October 1, 2020, will increase the Company’s home closing volume and Revenue by over 25% and thus decrease the percentage attributable to VPH (and other operating segments) in future years. The new H&H operating segment will be

presented as a new separate reporting segment in the Company’s December 31, 2020 audited financial statements.

* * * * *

If you have any questions with respect to the foregoing or if any additional supplemental information is required by the Staff, please contact Timothy S. Taylor of Baker Botts L.L.P. at (713)

229-1184.

|

Very truly yours,

|

||

|

DREAM FINDERS HOMES, INC.

|

||

|

By:

|

/s/ Robert E. Riva

|

|

|

Robert E. Riva

|

||

|

Vice President, General Counsel and Corporate Secretary

|

||

cc: Maryse Mills-Apenteng, Securities and Exchange Commission

Babette Cooper, Securities and Exchange Commission

Wilson Lee, Securities and Exchange Commission

Timothy S. Taylor, Baker Botts L.L.P.

Carina L. Antweil, Baker Botts L.L.P.

Michael Kaplan, Davis Polk & Wardwell LLP

Yasin Keshvargar, Davis Polk & Wardwell LLP