wish to participate in and finance the transaction, we turn to other potential financing sources. We believe our relationship with DF Capital allows us to act quickly when lot acquisition opportunities are presented because DF Capital generally provides for faster closings and is not subject to the time delays that we historically have experienced when seeking financing for projects. As of December 31, 2019 and September 30, 2020, we controlled 1,311 and 1,316 lots, respectively, through DF Capital managed funds, representing 14.9%, as of December 31, 2019, and 12.7%, as of September 30, 2020, of our total owned and controlled lots. See “Risk Factors—Risks Related to Our Business—There are various potential conflicts of interest in our relationship with DF Capital and certain of its managed funds, including certain of our executive officers and director nominees who are investors in certain funds managed by DF Capital, which could result in decisions that are not in the best interest of our stockholders” in this prospectus for additional information.

Fund I was fully committed in early 2019. Subsequently, we identified lot acquisitions that met our investment threshold, and DF Capital agreed to provide land bank financing for a total of seven of these projects. Doug Moran, our Senior Vice President and Chief Operations Officer, has invested $0.2 million in one of these funds managed by DF Capital as a limited partner. As of September 30, 2020, funds managed by DF Capital (other than Fund I) controlled an additional 339 lots as a result of these transactions outside of Fund I. During the nine months ended September 30, 2020, we purchased 91 of these lots for $7.4 million and the outstanding lot deposit balance in relation to these projects was $1.6 million. In addition, we paid lot options fees related to these transactions of $0.1 million for the year ended December 31, 2019 and $0.8 million for the nine months ended September 30, 2020.

Pre-Fund I Joint Ventures

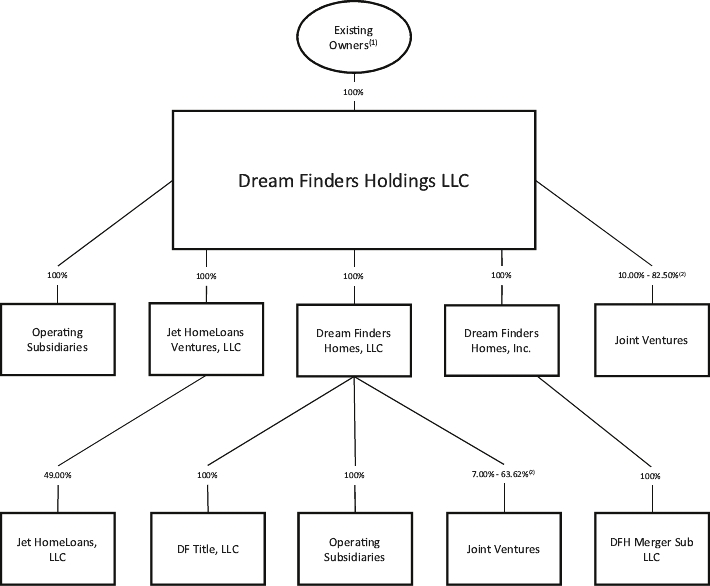

Historically, we entered into joint venture arrangements to complete certain land development, land acquisition and other homebuilding activities. Prior to the formation of Fund I, we entered into five joint ventures with DFH Investors, LLC, a company controlled by Mr. Lovett. Mr. Lovett was the managing partner of each of these joint ventures. Certain of our director nominees, executive officers and other members of management are limited partners in certain of these joint ventures. Messrs. Lovett and Walton, two of our director nominees, and Mr. Moran, our Senior Vice President and Chief Operations Officer, invested $1.5 million, $1.5 million and $0.2 million, respectively, in these joint ventures.

As of September 30, 2020, these joint ventures had sold and delivered all homes to end home customers. In each of these joint ventures, we owned between 53.6% and 63.6% of the joint venture and profits, less an overhead fee. During the years ended December 31, 2017, 2018 and 2019, respectively, and the nine months ended September 30, 2020, these joint ventures collectively had 52, 209, 119 and 16 lot transfers, respectively, to DF Homes LLC, and 28, 188, 169 and 43 home closings, respectively, resulting in $0.6 million, $8.6 million, $9.5 million and $2.2 million of net income, respectively. Our investment balance as of September 30, 2020 in these joint ventures was $0.4 million.

Prior to the formation of Fund I, we also entered into one joint venture with the Series B Investors. As of September 30, 2020, this joint venture was still operating and held 37 lots. We own 62.5% of this joint venture and receive pro rata profits and an overhead fee. During the twelve months ended December 31, 2017, 2018 and 2019, respectively, and the nine months ended September 30, 2020, this joint venture had 57, 34, 32 and 59 lot transfers, respectively, to DF Homes LLC, and 46, 42, 41 and 35 home closings, respectively, resulting in $0.7 million, $1.0 million, $1.1 million and $1.9 million of net income, respectively. Our investment balance as of September 30, 2020 in this joint venture was $3.2 million.

Guarantees

As of September 30, 2020, we have two outstanding guarantees in relation to debt agreements entered into by certain of our joint ventures. We and DF Capital, individually and collectively, guaranty an $18.0 million loan agreement in favor of the Series C Investors, whose borrowers are DFC Seminole Crossing, LLC, DFC East Village, LLC and DFC Sterling Ranch, LLC. These entities are joint ventures between us and Fund I. In addition, we have provided a guaranty in favor of Flagstar Bank in connection with a loan of $5.7 million, whose borrower is DFC Seminole Crossing, LLC. DFC Seminole Crossing, LLC is a joint venture between us and Fund I. Lastly, we, Mr. Zalupski, and DFH Mandarin Estates, LLC, individually and collectively, guaranteed