Exhibit 2.3

SECOND AMENDMENT TO PURCHASE AND SALE AGREEMENT

THIS SECOND AMENDMENT TO PURCHASE AND SALE AGREEMENT (this "Amendment")

is made as of the 7th day of September, 2021 by and among (i) each of the Persons identified as a "Seller" on the signature page hereto (each is a "Seller",

and collectively are the "Sellers); (ii) FRANK B. MCGUYER ("Owner),

MCGUYER INTERESTS, LTD., a Texas limited partnership ("McGuyer

Interests, and together with Owner, the "Interest Holders); (iii) DREAM FINDERS HOLDINGS LLC, a Florida limited liability company ("Buyer) and (iv) DFH COVENTRY, LLC, a Florida limited liability company ("Buyer Assignee"). Sellers, Interest Holders, Buyer Assignee and Buyer are referred herein collectively as the "Parties" and individually as a "Party".

RECITALS

WHEREAS, the Parties have entered into that certain

Purchase and Sale Agreement dated as of June 17, 2021 (the "Agreement") for the purchase and sale of the Purchased Assets as more particularly described in the

Agreement; and

WHEREAS, Parties entered into that certain First Amendment

to Purchase and Sale Agreement dated August 31, 2021 (the "First Amendment"). Sellers and Buyer mutually desire to amend the Agreement, as amended, on the

terms and conditions set forth in this Amendment; and

WHEREAS, except as otherwise defined herein, all

capitalized terms shall have the meaning ascribed in the Agreement.

NOW, THEREFORE, in consideration of the mutual agreements

set forth herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1. Assignment of the Agreement by Buyer; Newco.

(a) Pursuant to

Section 11.7 of the Agreement, Buyer has assigned its rights thereunder to its affiliate, DFH Coventry, LLC, and Buyer acknowledges and agrees that, as provided in Section 11.7 of the Agreement, such assignment does not relieve Buyer of any of

its obligations under the Agreement. The Parties agree that the notice provisions in the Agreement for Buyer shall remain unchanged.

(b) The

definition of Newco in Exhibit B of the Agreement is hereby deleted in its entirety and replaced with the following:

"Newco" means DFH Coventry, LLC, a Florida limited

liability company.

2. Notice to Proceed. Pursuant to Section 2.10 of the Agreement, Buyer is hereby providing Buyer’s Notice to Proceed to Seller by providing its written notice to Seller from a

Buyer named notice party expressly stating Buyer’s election to proceed beyond the Inspection Period.

3. Removal of Draft Header. The Parties agree that the header that reads "Foley Draft 6/15/21" on the first two pages of the Agreement is hereby deleted, with the Parties further

acknowledging and agreeing that the execution version of the Agreement inadvertently included the draft header.

4. Final Form of Exhibits.

(a) Attached

hereto as Appendix A1 is the form of Deed which the Parties agree shall serve as Exhibit C to the Agreement.

(b) Attached

hereto as Appendix A2 is the form of Bill of Sale which the Parties agree shall serve as Exhibit D to the Agreement.

(c) Attached

hereto as Appendix A3 is the form of Non-Foreign Affidavit which the Parties agree shall serve as Exhibit E to the Agreement.

(d) Attached

hereto as Appendix A4 is the form of Sale Assignment which the Parties agree shall serve as Exhibit F to the Agreement.

(e) Attached

hereto as Appendix A5 is the form of Assignment and Assumption Agreement which the Parties agree shall serve as Exhibit G to the Agreement.

(f) Attached

hereto as Appendix A6 is the form of Owner’s Affidavit which the Parties agree shall serve as Exhibit H to the Agreement.

(g) The Parties

agree that the form of Employment Agreement to which the Parties agree shall be attached hereto pursuant to an amendment, no later than the Closing Date and serve as Exhibit I to the Agreement.

(h) Attached

hereto as Appendix A8 is the form of form Warranty Services Agreement which the Parties agree shall serve as Exhibit J to the Agreement.

(i) Attached

hereto as Appendix A9 is the form of Assignment and Assumption Agreement for Acquisition Contracts which the Parties agree shall serve as Exhibit K to the Agreement.

(j) The Parties

agree that the form of Non-Competition Agreement to which the Parties agree shall be attached hereto pursuant to an amendment, no later than the Closing Date and serve as Exhibit L to the Agreement.

(k) Attached

hereto as Appendix A11 is the form of Land Purchase Option Agreement which the Parties agree shall serve as Exhibit M to the Agreement.

(l) Attached

hereto as Appendix A12 is the form of Subsequent Closing Escrow Agreement which the Parties agree shall serve as Exhibit N to the Agreement.

(m) Attached

hereto as Appendix A13 is the form of Shared Services Agreement which the Parties agree shall serve as Exhibit O to the Agreement.

(n) Attached

hereto as Appendix A14 is the form of Indemnity Escrow Agreement which the Parties agree shall serve as Exhibit P to the Agreement.

(o) Attached

hereto as Appendix A15 is the form of Warranty Reserve Escrow Agreement which the Parties agree shall serve as Exhibit Q to the Agreement.

(p) Attached

hereto as Appendix A16 is the form of True-Up Escrow Agreement which the Parties agree shall serve as Exhibit R to the Agreement.

(q) Attached

hereto as Appendix A17 is the form of Waiver and Release Agreement which the Parties agree shall serve as Exhibit S to the Agreement.

(r) Attached

hereto as Appendix A18 is the form of the Membership Interest Powers and the Limited Partnership Interest Powers (referenced in Sections 2.1.17 and2.1.18 of the

Agreement, as hereby amended which the Parties agree shall serve as Exhibit T to the Agreement.

(s) Attached

hereto as Appendix A19 is the form of Domain Name Assignment Agreement which the Parties agree shall serve as Exhibit U to the Agreement.

(t) Attached

hereto as Appendix A20 is the form of Social Media Assignment Agreement which the Parties agree shall serve as Exhibit V to the Agreement.

5. Schedule 2.1.1 Net Asset Value. Attached hereto as Appendix B is an updated Schedule 2.1.1

(including use of June 30, 2021 data and including the MHI Title Company and the MHI Mortgage Company valuations) which shall restate Schedule 2.1.1 in its entirety.

6. Builder Homesite. The Agreement is hereby amended as follows:

(a) Section

2.1.16 is restated in its entirety to read as follows:

"all ownership interests in FMR, IP, LLC, a Texas limited liability company."

(b) the following is added to Schedule 2.2 as an Excluded Asset:

"all ownership interest in Builder Homesite, Inc. ("BHI")."

(c) Section

VI(c)(i) of Schedule 2.1.8 is hereby deleted in its entirety.

(d) "Builder

Homesite, Inc. – Consent of shareholders" is hereby deleted from Schedule 3.4.16.

(e) "Builder

Homesite, Inc. Consent will be needed to sell/transfer all ownership interest in the Builder Homesite, Inc. stock if acquired as part of the Agreement." is hereby deleted from Schedule 4.4.

7. Sections 2.1.17 and 2.1.18. The Agreement is hereby amended by restating Section 2.1.17 and 2.1.18 thereof in their entirety as follows:

"2.1.17 the 60% membership interests owned by MHI Partnership, Ltd. in WKMM, LLC and the 49% membership interest owned by Frank

McGuyer in Millennium Title of Texas, L.C. (collectively "MHI Title Company"), it being understood that the acquisition of the membership interests of the MHI

Title Company shall be evidenced by providing a Membership Interest Power in the form attached hereto as Exhibit T (the "Membership Interest Powers"). and for the purchase price of amount of investment for the MHI Title Company set forth on Schedule 2.1.1 (the "Title Company Purchase Price").

"2.1.18 the 75% limited partnership interest owned by Land Investment Management Corp. in FC Lending, Ltd. and the 65% limited

partnership interest owned by McGuyer 2007 Partnership, LLP in Cornerstone Mortgage Partners of Texas, LP (collectively "MHI Mortgage Company"), it being

understood that the acquisition of the ownership interest in the MHI Mortgage Company shall be evidenced by providing a Limited Partnership Interest Power in the form attached hereto as Exhibit T (the "Limited Partnership Interest Powers") and for the purchase price as the amount of investment in the MHI

Mortgage Company set forth on Schedule 2.1.1 (the "Mortgage Company Purchase Price" and collectively with the Title Company Purchase Price the "MHI Entities Purchase Price").

8. Section 2.3 Assumed Liabilities. The Agreement is hereby amended by restating Section 2.3 thereof in its entirety as follows:

"On the Closing Date, effective as of the Effective Time, Buyer shall assume and agree to discharge or otherwise perform when

due those liabilities of the Sellers set forth on Schedule 2.3 and liabilities arising from and after the Closing under the Assumed Contracts (the "Assumed Liabilities")."

9. Schedule 2.3 Assumed Liabilities. This Schedule is the amounts of Accrued Liabilities and Trade Accounts Payable set forth on Schedule 2.1.1

10. Schedule

2.5.1 Purchase Price Updates.

(a) Schedule 2.5.1(A)(1) Net Asset Value Calculation. Attached hereto as Appendix D

is an updated Schedule 2.5.1(A)(1) which shall restate Schedule 2.5.1(A)(1) in its entirety.

(b) Section 2.5.1 2.5.2 and 2.5.3 are amended and restated as follows:

2.5.1

Purchase Price. The purchase price to be paid by Buyer for the Purchased Assets (the "Purchase Price), shall be the sum of:

(A) the aggregate book value of the Purchased Assets (excluding amounts attributable to goodwill and other

intangibles, if any, and adjusted as necessary to comply with GAAP) less the amount of the Assumed Liabilities (the "Net Asset Value);

(1) The Net Asset Value will be calculated using generally accepted accounting principles as consistently applied by the Sellers ("GAAP) and in a manner consistent with the Net Asset Value calculation set forth on Schedule

2.1.1 utilized in calculating the target purchase price (the "Target Purchase Price Schedule").

(2) Based on the NAV Schedule attached as Schedule 2.1.1

the aggregate book value of the Purchased Assets is $515,955,936, (b) the Assumed Liabilities are $90,387,843, and (c) resulting in a Net Asset Value of $425,568,093.

(3) The aggregate book values of the Purchased Assets, the amount of the Assumed Liabilities, the Net Asset Value and the

Purchase Price will calculated at Closing and adjusted pursuant to Section 2.6 below (i.e.,

the True‑Up);

(4) For the avoidance of doubt, any Subsequent Parcels (see Section 3.8), but not MHI Models, have been excluded from the Net Asset Value.

plus an amount equal to Fifty Million Dollars ($50,000,000.00) (the "Premium). The Premium shall be a fixed value and shall not be

adjusted pursuant to Section 2.6 below.

Based on the NAV Schedule attached as Schedule 2.1.1, target Purchase

Price would be $475,568,093, the sum of the Net Asset Value of $425,568,093 and the Premium of $50,000,000.

(c) Attached

hereto as Appendix B is an updated Schedule 2.1.1 which shall restate Schedule 2.1.1 in its entirety.

2.5.2 Closing Purchase Price. On or before seven

(7) days prior to Closing, Sellers shall submit to Buyer updated versions of all applicable Schedules using financial information as of August 31, 2021 (unless the Closing Date is extended) (the "Closing Adjusted Schedules) calculated using GAAP as consistently applied by the Sellers and in a manner consistent with the Net Asset Value calculation set forth on the Target Purchase Price Schedule.

Based on the Closing Adjusted Schedules, Buyer shall prepare and deliver to Sellers, within five (5) days after Buyer's receipt of the Closing Adjusted Schedules, the Closing Schedule of Net Asset Value ("Closing NAV Schedule), with updated aggregate book values for the Purchased Assets to be purchased at the initial Closing, adjusted (up or down, as applicable) to reflect increases or decreases in the

amount of the aggregate book value of the Purchased Assets (e.g., the exclusion of any Subsequent Parcels) and updated amounts for the Assumed Liabilities.

The Net Asset Value and the Purchase Price for the Purchased Assets to be purchased at Closing shall be calculated based on the Closing NAV Schedule. The Net Asset Value, as calculated based on the Closing NAV

Schedule, shall be the "Closing Net Asset Value", and the Purchase Price for the assets to be purchased at the initial Closing, as calculated based on the Closing NAV Schedule, plus the Premium shall be the "Closing Purchase Price".

2.5.3 Payment of Closing Purchase Price. On the

Closing Date, the Closing Purchase Price shall be paid by Buyer to Sellers as follows:

Buyer shall deposit with the Title Company the amount of Five Million Dollars ($5,000,000.00) of the Closing Purchase Price (the "Indemnity Escrow" and such amount, including any interest or other amounts earned thereon and less any disbursements therefrom in accordance with the Indemnity Escrow Agreement, the "Indemnity Escrow Fund), which shall be used to indemnify Buyer for any Damages as more fully described in Section

10.2 and pursuant to the Indemnity Escrow Agreement.

Buyer shall deposit with the Title Company the amount of Ten

Million Dollars ($10,000,000.00) of the Closing Purchase Price (the "True-Up Escrow" and such amount, including any interest or other amounts earned thereon and less any disbursements therefrom in accordance with the True-Up Escrow Agreement, the "True-Up Escrow Fund), which shall be used to indemnify Buyer for any Damages as more fully described in Section 2.6 below, Section 3.1 (regarding reconciliation to pay off debt secured by any of the Initial Closing Assets), and pursuant to the True-Up Escrow Agreement in the form attached as Exhibit R (the "True-Up Escrow Agreement").

Buyer shall deposit with the Title Company the amount of Three

Millions Dollars ($3,000,000.00) of the Closing Purchase Price (the "Warranty Reserve Escrow" and such amount, including any interest or other amounts earned thereon and less any disbursements therefrom in accordance with the Warranty Reserve Escrow Agreement, the "Warranty Reserve Escrow Fund), which shall be applied or returned to Sellers as provided in the Warranty Service

Agreement (see Section 6.8) and pursuant to the Warranty Reserve Escrow Agreement

in the form attached as Exhibit Q (the "Warranty Reserve Escrow Agreement").

Buyer shall pay the remainder of the Closing Purchase Price and the amount required to release the mortgage liens on the Real Property being

purchased at the Initial Closing ("Closing Cash Payment) to the order of Sellers by wire transfer of immediately available funds, in accordance with written

instructions provided by Sellers. For avoidance of doubt, the Closing Purchase Price shall not include the amounts set forth on the NAV Schedule related to assets owned by MHI Models (other than the San Antonio office building owned by Models which

shall be acquired at the initial Closing) to be acquired pursuant to Section 3.9 and paid at the contemplated closings thereby.

11. Schedule 2.7 Allocation of Purchase Price. Attached hereto as Appendix E is Schedule 2.7 to the

Agreement, which shall be determined after the date of this Amendment, but prior to closing pursuant to an amendment to this Agreement.

Section 3.1 Closing Date. The

Agreement is hereby amended by restating Section 3.1 thereof in its entirety as follows:

"Closing Date. The closing of the purchase and sale

of the Purchased Assets to be purchased at the initial Closing as provided in this Agreement (the "Closing") shall be held as an escrow closing coordinated by the Title Company on October 1, 2021 (which may be extended by Buyer for up to thirty

(30) additional days by written notice to Sellers given at least five (5) Business Days prior to the Closing Date), or such other mutually agreed to time and place, provided the satisfaction or waiver of all conditions to Closing set forth in ARTICLE 8 below have been met. In the event that all conditions to Closing have not been satisfied or waived on or prior to October 1, 2021 (as may have been extended), then

the Closing shall be held on the next immediate month end date following the date on which all conditions to Closing set forth in ARTICLE 8 below have been met. For all

purposes of this Agreement, the Closing occur on the last day of a month and shall be effective as of 12.01 a.m., Houston, Texas time, on the Closing Date (the "Effective

Time"). The date of the Closing is referred to herein as the "Closing Date."

The Purchased Assets to be purchased at the initial Closing shall be as follows: (1) All finished homes, (2) all Work-in-Progress Units, (3) all

Finished Lots other than the Lots and/or Land designated as Subsequent Parcels or subject to Section 3.9(b), and (4) the San Antonio office building in the name of MHI Models (collectively, the "Initial Closing Assets"). Buyer and Sellers agree that at Closing, Buyer may elect to utilize amounts from the True-Up Escrow Fund with the Title Company for the Closing Cash Payment being used to pay off debt secured by

any of the Initial Closing Assets, provided, however, no later than thirty (30) days after Closing, Buyer and Sellers agree to use good faith efforts to make a final reconciliation with respect to the correct pay off any debt secured by such

Initial Closing Assets. The provisions of this Section 11 of this Amendment shall survive Closing.

12. Bill of Sale. The Agreement is hereby amended by restating Section 3.4.3 thereof in its entirety as follows:

"An Assignment and Bill of Sale and Assumption Agreement in the form attached as Exhibit D (the "Bill

of Sale), duly executed by each Seller."

13. Employment Agreements. The Agreement is hereby amended by restating Section 3.4.9 thereof in its entirety as follows:

“A copy of an employment agreement duly executed by the Executive Team of Sellers in the form to be agreed upon after the end of

the Inspection Period and added to this Agreement by an amendment after the date of this Second Amendment, but as a condition to Closing.”

14. Non- Competition Agreements. The Agreement is hereby amended by restating Section 3.4.12 thereof in its entirety as follows:

“A copy of the Non-Competition Agreement, duly executed by each Seller and Interest Holders in the form to be agreed upon after

the end of the Inspection

Period and added to this Agreement by an amendment after the date of this Second Amendment, but as a condition to Closing.”

15. Schedule 3.4.16 Required Consents. Attached hereto as Appendix F is an updated Schedule 3.4.16 to

the Agreement which shall restate Schedule 3.4.16 in its entirety.

16. New Section 3.4.26 IP Assignments. The Agreement is hereby amended by adding a new Section 3.4.26 as follows:

"IP Assignment Documents. A Domain

Name Assignment Agreement in the form as set forth on Exhibit U, and a Social Media Assignment in the form as set forth on Exhibit V (collectively, the "IP Assignment Agreements"), each duly executed by the applicable Seller other than FMR."

17. New Section 3.4.27 Equity Transfer Documents. The Agreement is hereby amended by adding a new Section 3.4.27 as follows:

"Equity Transfer Documents. The

Membership Interest Powers and the Limited Partnership Interest Powers, each duly executed by the applicable owner of the equity interest."

18. New Section 3.5.19 IP Assignments. The Agreement is hereby amended by adding a new Section 3.5.19 as follows:

"IP Assignment Documents. The IP

Assignment Agreements, each duly executed by Buyer."

19. Schedule 3.8 Subsequent Parcels. Pursuant to an amendment prior to Closing, attached hereto as Appendix F

is an updated Schedule 3.8 which shall restate Schedule 3.8 in its entirety.

20. Section 3.9 Closings after the Initial Closing. Section 3.9 is added to the Agreement as follows;

(i) Newco shall

acquire all of the Model Homes set forth on Schedule 2.1.6 that are owned by MHI Models together with any Model Homes acquired by MHI Models in the

interim period between the date of that Schedule and the closing date set forth below for an amount to be calculated as to the assets being acquired in accordance with the provisions of Section 2.5.1 applied to the assets of MHI Models and shall

pay all amounts owed by MHI Models to lenders secured by such Model Homes. Newco shall close the purchase of the Model Homes on or before December 17, 2021. The MHI Models closing will be conducted pursuant to the terms of this Agreement. Unless

otherwise agreed by MHI Models, the closing shall include all Model Homes in a single closing.

(ii) The Model

Homes are excluded from the Purchased Assets to be purchased on the Closing Date and shall not be conveyed to Buyer at Closing, and the Purchase Price and Closing Cash Payment do not include any amounts attributable to the Model Homes. At the

time of closing of the Model Homes, amounts for taxes, homeowner association dues, and assessments and similar costs incurred by Sellers during the interim period from the Closing Date to the date of closing on the Model Homes shall be paid to

MHI Models. The Model Homes will be conveyed by a Deed in substantially the form attached to this Agreement.

(iii) On the Closing Date, the Buyer shall execute a Lease Assumption Agreement in the form attached hereto as Schedule

3.9 assuming all of MHI Partnership’s obligations pursuant to the Master Lease Agreement between MHI Models and MHI Partnership for the period from the Closing Date until Buyer’s acquisition of the Model Homes.

(b) MHI Partnership Developments. MHI Partnership has acquired certain development tracts and it is contemplated by the parties that Newco shall acquire lots developed by MHI

Partnership in such developments. The parties contemplate entering into mutually acceptable arrangements pursuant to which MHI Partnership will “land bank” such development tracts but such agreements are not a condition to Closing.

21. Section 4.27 is amended and restated as follows:

(a) MHI Title Company; MHI Mortgage Company.

(i) Schedule 4.27.1 to the best of Sellers’ knowledge, contains the true, correct and complete copies of the articles of incorporation, bylaws, articles of

formation and/or operating agreements, as applicable (collectively, the "Organizational Documents"), for MHI Title Company and MHI Mortgage Company

(collectively, the "Service Companies"), together with any amendments thereto.

(ii) To the best

of Sellers’ knowledge, the Service Companies do not own, directly or indirectly, any capital stock, or other equity interest in any corporation, partnership, trust, limited liability company or other legal entity except as disclosed on Schedule 4.27.2 ,

(iii) The equity

interests of each of the Service Companies (collectively, the "Equity Interests") are owned by MHI Partnership, Ltd., Frank McGuyer, Land Investment

Management Corp., and McGuyer 2007 Partnership, LLP and contemplated to be sold to Buyer hereunder were, to the best of Seller’s knowledge, issued in compliance with applicable Laws and Regulations and constitute the percentage ownership of the

total issued and outstanding Equity Interests in the applicable Service Company indicated on Schedule 4.27.1. To the best of Seller’s knowledge, the Equity Interests in MHI Title Company and MHI Mortgage Company were not issued in violation of

the Organizational Documents of the applicable entity or any other agreement, arrangement, or commitment to which

Seller or the applicable Service Company is a party and are not subject to or in violation of any preemptive or similar rights of any Person.

(iv) MHI

Partnership, Ltd., Frank McGuyer, Land Investment Management Corp., and McGuyer 2007 Partnership, LLP own the Equity Interests free and clear of all Encumbrances.

(v) The Sellers

have provided Access to the financial statements and income statements in the Sellers’ possession that the Sellers have received from the general partner or manager (as applicable) of the Service Companies for fiscal years 2019, 2020 and 2021,

and such financial statements and income statements are true, correct and complete copies of what the Sellers have received or what is in the Sellers’ possession.

(vi) There are

no outstanding or authorized options, warrants, convertible securities or other rights, agreements, arrangements or commitments of any character relating to any Equity Interests held by a Seller in the Service Companies or obligating any Seller

to issue or sell any such Equity Interests in the Service Companies. Other than the Organizational Documents, there are no voting trusts, proxies, or other agreements or understandings in effect with respect to the voting or transfer of any of

Seller’s Equity Interests. To the Knowledge of each Seller, there are no outstanding obligations of the Service Companies to repurchase, redeem, or otherwise

acquire any of Sellers’ Equity Interests.

22. Section 4.28 is added to the Agreement as follows: 4.28 FMR.

(a) FMR does

not own, directly or indirectly, any capital stock, or other equity interest in any corporation, partnership, trust, limited liability company or other legal entity,

(b) The equity

interests in FMR are owned 87% by Frank McGuyer, and 13% by the Estate of Ralph S. O’Connor. The membership interests in FMR were not issued in violation of the organizational documents of FMR or any other agreement, arrangement, or commitment

to which Frank McGuyer, the Estate of Ralph S. O’Connor or FMR is a party and are not subject to or in violation of any preemptive or similar rights of any Person.

(c) Frank

McGuyer, and the Estate of Ralph S. O’Connor own the membership interests in FMR free and clear of all Encumbrances.

(d) The Sellers

have provided Access to the financial statements of FMR in the Sellers’ possession.

(e) There are

no outstanding or authorized options, warrants, convertible securities or other rights, agreements, arrangements or commitments of any character relating to any membership interests in FMR. There are no voting trusts, proxies, or other

agreements or understandings in effect with respect to the voting or transfer of any of the membership interests in FMR.

23. Schedule 7.8. Section 7.8 is amended and restated as follows:

(a) Employees.

(i) Offer of Employment. In regard to employees of the Business, except for those employees who will

enter into Employment Agreements, on or prior to the Closing Date, Buyer shall offer employment, on an at-will basis, effective as of the Employee Transfer Date (January 1, 2022) and conditioned on the Closing, to at least the applicable number

of employees of Sellers ("Continuing Employees) to meet the exclusion requirements for compliance with the Worker Adjustment and Retraining Notification Act (codified at, 29 U.S.C. Sections 2101-2109), or any similar state or local law (collectively, the "WARN Act) or the applicable state equivalent that is applicable.

(ii) Hiring of Continuing Employees by Buyer. Following the Effective Date and after notice to the

Sellers, Buyer may contact and interview any employees of a Seller, inspect their personnel records (upon receipt of permission from the employee), and solicit them to become employees of Buyer as of the Employee Transfer Date in accordance with

Section 7.8, (as amended and set forth herein). The Sellers shall cooperate with and assist Buyer in the interview and evaluation process by providing Access to or

copies of such information, personnel records and evaluations concerning the employees as Buyer may reasonably request, provided that the subject employee has consented thereto, and by rescinding, waiving or terminating any non-compete agreements

between any Seller and any such employees. Sellers will terminate their employment arrangement with each Continuing Employee effective as of the Employee Transfer Date, and will be responsible for all back vacation pay, accrued salary and

benefits, severance pay and any other liability, regarding any matter, owed to them as of that date. Buyer will not terminate the employment of the Continuing Employees for a minimum period of sixty (60) days if such termination would expose

Sellers to liability under the WARN Act (and the regulations promulgated thereunder), and Buyer will indemnify and hold harmless Sellers with respect to any liability incurred by the breach by Buyer of its obligations under this Section 7.8.

(iii) From the

Closing Date until the Employee Transfer Date, employees shall remain the employee of the applicable Seller. At and after the Employee Transfer Date, the Continuing Employees will cease to participate in any and all of the employee plans of

Sellers. Buyer and its Affiliates shall pay, discharge and be responsible for all salary, wages, severance costs, benefits and claims (including workers compensation or other similar benefits and claims) arising out of the employment of the

Continuing Employees commencing after the Closing, without exception.

(iv) To the extent

service is relevant for the purpose of eligibility, participation, vesting, benefit contributions, benefit calculations or allowances (including, without limitation, entitlement to vacation and sick days) under any benefit plan, program or

arrangement established or maintained by Buyer or its Affiliates for the benefit of the employees of Buyer or its Affiliates and in which the Continuing Employees are allowed to participate, such plan, program or arrangement shall credit the

Continuing Employees for service on and prior to the Employee Transfer Date with Sellers to the extent permitted by any such plan, program or arrangement. In addition, Buyer shall give credit to Continuing Employees for any deductibles,

co-payments, out of pocket payments or pre-existing condition waiting periods satisfied under Sellers' group health plan and such Continuing Employees shall not be subject to any eligibility waiting periods under Buyer's group health plan.

(v) Non-Solicitation of Buyer Employees. For a period of thirty-six (36) months commencing on the Closing Date, the Sellers and Owner shall

not, and shall not permit any of their Affiliates to, directly or indirectly, hire or solicit any employee of Buyer (including those employees listed on Schedule 4.15) or encourage any such employee to leave such employment or hire any employee

who has left such employment, except pursuant to general solicitation which is not directed specifically to any such employees. This provision shall survive Closing.

(vi) No Rights for Seller Employees. This Agreement is not intended to create and does not create any contractual or legal rights in or enforceable by any employee

of a Seller.

Employee Costs during interim period from Closing Date until Employee Transfer

Date. Buyer shall either pay or reimburse the applicable Seller for all employee costs for the period from the Closing Date to the Employee Transfer Date.

24. Builders Advisor Group.

(a) The

Agreement is hereby amended by restating Section 10.2.3 thereof in its entirety as follows:

"any claim by any Person for brokerage or finder's fees or commissions or similar payments based

upon any agreement or understanding alleged to have been made by any such Person with a Seller (or any Person acting on its behalf) in connection with any of the Contemplated Transactions, except as set forth in Section 3.2 (concerning the Buyer's agreement to pay ½ of the commission payable when such amounts are due to Builders Advisor Group.

(b) The

Agreement is hereby amended by restating Section 10.3.3 thereof in its entirety as follows:

"any claim by any Person for brokerage or finder's fees or commissions or similar payments based upon any agreement or

understanding alleged to have been made by such Person with Buyer (or any Person acting on its behalf) in connection with any of the Contemplated Transactions, except as set forth in Section

3.2 (concerning the Sellers’ agreement to pay ½ of the commission payable when such amounts are due to Builders Advisor Group.

25. Closing Adjusted Schedules Date. The first sentence of Section 2.5.2 is hereby deleted in its entirety and replaced with the following:

"On or before seven (7) days prior to the Closing, Sellers shall submit to Buyer updated versions of all Article 2 Schedules

using financial information as of August 31, 2021, unless the Closing Date is extended, in which case it would be as of September 30, 2021 (the "Closing Adjusted

Schedules) calculated using GAAP as consistently applied by the Sellers and in a manner consistent with the Net Asset Value calculation set forth on the Target Purchase Price Schedule. Based on the Closing Adjusted Schedules, Buyer shall

prepare and deliver to Sellers , within five (5) days after Buyer's receipt of the Closing Adjusted Schedules, the Closing Schedule of Net Asset Value ("Closing NAV

Schedule), with updated aggregate book values for the Purchased Assets being purchased at the initial Closing adjusted (up or down, as applicable) to reflect increases or decreases in the amount of the aggregate book value of the

applicable Purchased Assets (e.g., the exclusion of any Subsequent Parcels) and updated amounts for the Assumed Liabilities."

26. Update to Section 10.3.5. The Agreement is hereby amended by restating Section 10.3.5 thereof in its entirety as follows:

"any Assumed Liability and the indemnification obligations of Buyer set forth in Section 7.5.2."

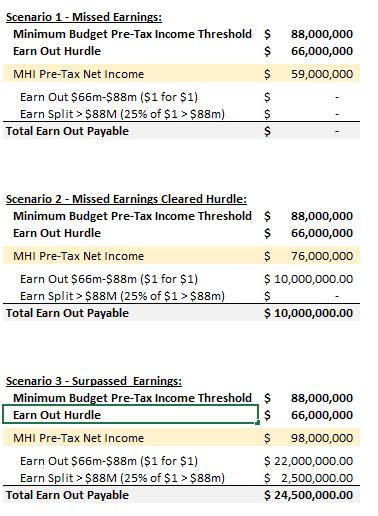

27. Minimum

Budget Pre-Tax Income Threshold Definition.

(a) The

definition of Minimum Budget Pre-Tax Income Threshold in Exhibit B of the Agreement is hereby deleted in its entirety and replaced with the following:

"Minimum Budget Pre-Tax Income Threshold"

means the Newco's Pre-Tax Income of at least the following amounts for the respective Earn Out Years: Earn Out Year 2021 (Closing Date to 12/31/2021) – $25,000,000; Earn Out Year 2022 - $88,000,000; Earn Out Year 2023 – $97,000,000; Earn Out Year

2024 - $106,000,000; and Earn Out Year 2025 – $84,000,000 (January 1, 2025 to the end of the 48th month from Closing Date) as may be adjusted pursuant to Section 2.8.1 herein and assuming an October 1, 2021 Closing Date.

"MHI Business Plan" means the 2021 MHI

Partnership Business Plan posted in the Data Room file numbers 1.6.1.5, named 12 31 21 MHI Plan v6.xlsx.

By way of example and illustration only, and not limitation, the following are examples of three scenarios an Earn Out calculations for a hypothetical year in 2022:

28. Revenue

Definition.

(a) The

definition of Revenue in Exhibit B of the Agreement is hereby deleted in its entirety and replaced with the following:

"Revenue" means the revenue of Newco

related to homebuilding activities on lots owned by clients using the completed-contract method and revenue of Newco related to homebuilding activities on lots owned by Newco using the deposit method. For the avoidance of doubt, when calculating

Pre-Tax Income following Closing under the Agreement, "Revenue" shall include Newco’s share of the income from the MHI Mortgage Company and MHI Title Company and is intended to be the Business as operated by Newco in accordance with the

requirements of Section 2.8.

29. Permitted

Encumbrances Definition.

(a) The

definition of Permitted Encumbrances in Exhibit B of the Agreement is hereby deleted in its entirety and replaced with the following:

"Permitted Encumbrances" means: (a)

Encumbrances securing general real property taxes which are not yet delinquent; (b) Taxes imposed with respect to the Purchased Assets which are not yet due and

payable as of the Closing Date or which are being contested by appropriate Proceedings; (c) liens held by lenders and second lien deeds of trust in connection with lot acquisitions to the extent they are denoted as Assumed Liabilities; (d) matters disclosed in the Survey, plats, or Sellers Existing

Title Policies; (e) statutory liens of landlords, carriers, warehousemen, mechanics and materialmen or other similar liens incurred in the ordinary course of business consistent with past practices for sums not yet due; (f) liens incurred or deposits made in the ordinary course of business consistent with past practices in connection with workers' compensation, unemployment

insurance and other types of social security, (g) rights of other parties to the Assumed Contracts, (h) easements, rights-of-way, restrictions and other similar charges and encumbrances not interfering with the ordinary course of business of Sellers; (i) Encumbrances securing Assumed

Liabilities; (j) Encumbrances to be discharged at Closing or as otherwise permitted by this Agreement (in connection with reconciliations with the Agreement); (k) liens secured by the Subsequent Parcels. However, "Permitted Encumbrances"

exclude liens encumbrances, charges, mortgages or security interests which shall be released and discharged at or prior to the Closing.

30. List of Exhibits. "Exhibit R – Form of True-Up Escrow Agreement," Exhibit S – Form of Waiver and Release Agreement; Exhibit T – Master Lease Assumption Agreement; Exhibit U –

Domain Name Assignment Agreement; and Exhibit V – Social Media Assignment Agreement; are added to the list of Exhibits on page A-1 of the Agreement.

31. MHI

Online.

(a) The

definition of Access in Exhibit B of the Agreement is hereby deleted in its entirety and replaced with the following:

"Access" with respect to any document(s)

means: (i) Sellers have delivered such document to Buyer, (ii) caused such document to be delivered to Buyer, (iii) has made such document(s) to be readily available to Buyer either in one location on the Data Room in a reasonably organized manner

or at the office of the applicable Seller where such document(s) are regularly maintained as requested by Buyer or available in the Data Room, or (iv) has made such document(s) available to Buyer thru access granted to "MHI-Online" intranet portal

at https://mhionline.mhinc.com/ ."

32. Master Waiver and Release Agreement. The Parties agree that the Master Waiver and Release Agreement attached hereto as Appendix A17 (Exhibit S) shall be added as a "Closing Agreement" under the Agreement and each applicable Party thereto shall deliver executed copies of the same at Closing.

33. Effect of Amendment. To the extent any provisions contained herein conflict with the Agreement or any other agreements between Seller and Purchaser, oral or otherwise, the

provisions contained herein shall supersede such conflicting provisions contained in the Agreement or other agreements. Except as specifically modified by this Amendment, the Agreement remains in full force and effect and is in all events

ratified, confirmed and approved.

34. Counterparts. This Amendment may be executed in multiple counterparts, each of which shall be deemed to be an original, but all of which, together, shall constitute one and

the same instrument. Delivery of signatures by e-mail or facsimile shall be valid and binding.

[signature page follows]

IN WITNESS WHEREOF, the parties hereto have caused this

Amendment to be executed and delivered as of the day and year first above written.

|

BUYER:

|

DREAM FINDERS HOLDINGS LLC,

|

|

|

a Florida limited liability company

|

||

|

By:

|

/s/ Doug Moran | |

|

Name: Doug Moran

|

||

|

Title: COO

|

||

|

BUYER ASSIGNEE:

|

DFH Coventry LLC,

|

|

|

a Florida limited liability company

|

||

| By: |

/s/ Doug Moran

|

|

|

Name: Doug Moran

|

||

|

Title: COO

|

||

|

INTEREST HOLDERS:

|

/s/ Frank B. McGuyer

|

|

|

Frank B. Mcguyer, an individual

|

||

|

McGuyer Interests, Ltd.,

|

||

|

a Texas limited partnership

|

||

| By: |

/s/ Frank B. McGuyer

|

|

|

Name: Frank B. McGuyer

|

||

|

Title: Managing General Partner

|

||

|

SELLERS:

|

MHI Partnership, Ltd.,

|

|

|

a Texas limited partnership

|

||

| By: |

/s/ Frank B. McGuyer

|

|

|

Name: Frank B. McGuyer

|

||

|

Title: Founder and Executive Chairman

|

||

Signature Page for Second Amendment

to Purchase and Sale Agreement

|

MHI Models, Ltd., a Texas limited partnership

|

||

| By: |

/s/ Frank B. McGuyer

|

|

|

Name: Frank B. McGuyer

|

||

|

Title: CEO and Chairman

|

||

|

Mcguyer Homebuilders, Inc.

|

||

|

a Texas corporation

|

||

| By: |

/s/ Frank B. McGuyer

|

|

|

Name: Frank B. McGuyer

|

||

|

Title: Founder and Executive Chairman

|

||

|

HOMECO PURCHASING COMPANY, Ltd.,

|

||

|

a Texas limited partnership

|

||

| By: |

/s/ Frank B. McGuyer

|

|

|

Name: Frank B. McGuyer

|

||

|

Title: Founder and Executive Chairman

|

||

|

2019 Sonoma, LLC

|

||

|

a Texas limited liability company

|

||

| By: |

/s/ Frank B. McGuyer

|

|

|

Name: Frank B. McGuyer

|

||

|

Title: CEO

|

||

Appendix A1

Form of Deed

Appendix A2

Form of Bill of Sale and Assumption

Appendix A3

Form of Non-Foreign Affidavit

Appendix A4

Form of Sale Assignment

Appendix A5

Form of Assignment and Assumption Agreement

Appendix A6

Form of Owner’s Affidavit

Appendix A7

Form of Employment Agreement

Appendix A8

Form of Warranty Services Agreement

Appendix A9

Form of Assignment and Assumption Agreement for Acquisition Contracts

Appendix A10

Form of Non-Competition Agreement

Appendix A11

Form of Land Purchase Option Agreement

Appendix A12

Form of Subsequent Closing Escrow Agreement

Appendix A13

Form of Shared Services Agreement

Appendix A14

Form of Indemnity Escrow Agreement

Appendix A15

Form of Warranty Reserve Escrow Agreement

Appendix A16

Exhibit R: Form of True-Up Escrow Agreement

Appendix A17

Exhibit S: Form of Waiver and Release Agreement

Appendix A18

Exhibit T: Form of Membership Interest Powers & Limited Partnership Interest Powers

Appendix A19

Exhibit U: Form of Domain Name Assignment Agreement

Appendix A20

Exhibit V: Form of Social Media Assignment

Appendix B

Schedule 2.1.1

Appendix C

Schedule 2.3

Appendix D

Schedule 2.5.1(A)(1)

Appendix E

Schedule 2.7

Appendix F

Schedule 3.4.16

Appendix G

Schedule 3.8