of broadcast communication towers that he founded in 1994, and TowerCom Development, LP, a developer of wireless communications infrastructure that he founded in 1997. TowerCom, Ltd and TowerCom Development, LP have each generated over 90% compounded annual rates of return for their investors. In 2007, he founded TowerCom, LLC and has since served as its Chairman and Chief Executive Officer. Mr. Lovett also co-founded Lovett Miller & Co. in 1997, a venture capital firm that focuses in technology-enhanced services and healthcare companies. Prior to co-founding Lovett Miller & Co., he served as the President of Southcoast Capital Corporation, a family holding company that invests in private equities, public equities and real estate. Prior to serving as President of Southcoast Capital Corporation, Mr. Lovett worked for the Lincoln Property Company and in the Corporate Finance Department of Merrill Lynch. Mr. Lovett has made venture capital investments in the following companies: RxStrategies, Inc., EverBank Financial Corporation, Healthcare Solutions, Inc. (formerly Cypress Care, Inc.), Care Anywhere, Inc., K&G Men’s Centers, Inc., Sigma International Medical Apparatus, Go Software, Inc., Main Bank Corporation, PowerTel, Inc. and Southcoast Boca Associates. He currently serves on the board of directors of the following companies: DocuFree Corporation and TowerCom, LLC. Mr. Lovett also currently serves on the board of directors for Florida Prepaid College Board. Mr. Lovett previously served on the board of trustees and was co-chairman of the Capital Campaign for the University of North Florida. Mr. Lovett also previously served on the board of directors of EverBank Financial Corporation (formerly a publicly traded company) and was the chairman of the Youth Crisis Center and the Jacksonville Jaguars Honor Rows Program.

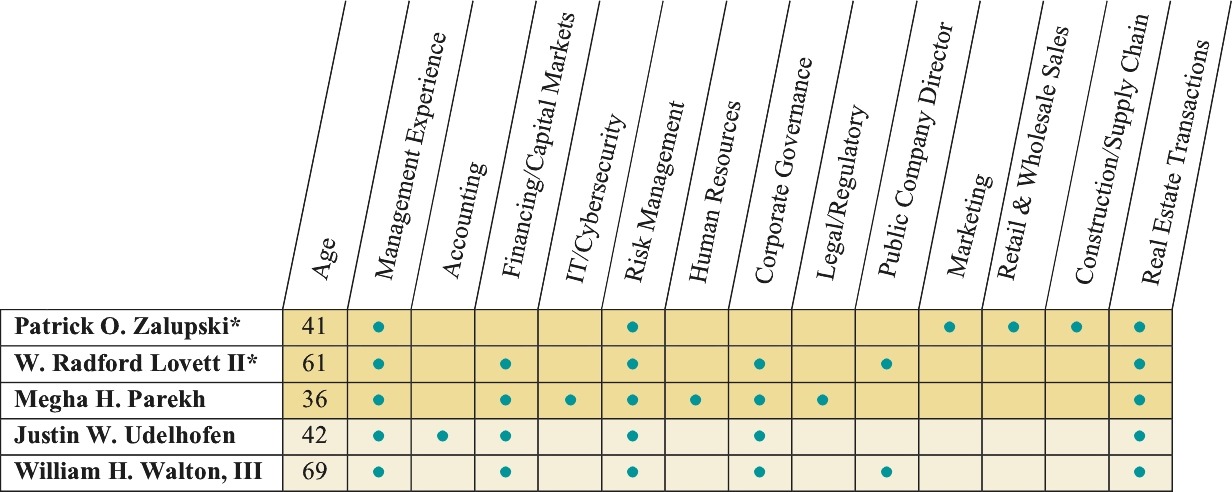

Mr. Lovett’s extensive experience serving on boards of directors and 20 years of executive leadership experience and management experience make him qualified to serve on the Board of Directors. Mr. Lovett is the chair of our Compensation Committee and a member of our Nominating and Governance Committee.

Megha H. Parekh | | | Director |

Ms. Parekh, age 36, has served as a member of the Board of Directors since January 2021. In 2013, Ms. Parekh joined the Jacksonville Jaguars, a professional football franchise based in Jacksonville, Florida, as Vice President and General Counsel and, in 2016, was promoted to her current position as Senior Vice President and Chief Legal Officer. Ms. Parekh manages the legal, technology, security, capital improvements and people development teams at the Jacksonville Jaguars. Since joining the Jacksonville Jaguars, Ms. Parekh has also worked on a number of other acquisitions and business ventures for Shad Khan, the Jacksonville Jaguars’ owner, including serving as Chief Legal Officer for Iguana Investments Florida, LLC and Chief Legal Officer for All Elite Wrestling, LLC. Prior to joining the Jacksonville Jaguars, Ms. Parekh worked in the New York office of the international law firm Proskauer Rose LLP, where she practiced corporate law and worked on public and private acquisitions and financings and securities offerings. Ms. Parekh currently serves on the board of directors of the Jacksonville Jaguars Foundation, Inc. and the Florida Sports Foundation, Inc. and on the board of managers of the Black News Channel, an American broadcast television news channel based in Tallahassee, Florida targeting the African American demographic.

Ms. Parekh’s 12 years of experience in acquisitions and business ventures and her legal expertise make her qualified to serve on the Board of Directors. Ms. Parekh is the chair of our Nominating and Governance Committee and a member of our Audit Committee and our Compensation Committee.

Justin W. Udelhofen | | | Director |

Mr. Udelhofen, age 42, has served as a member of the Board of Directors since January 2021. He also served on the board of managers of DFH LLC from December 2014 to January 2021. Mr. Udelhofen has been a private investor since July 2020. He previously founded Durant Partners LLC in October 2016, an investment fund that focuses on small-to-mid-capitalization equities, and served as Principal until June 2020. Prior to founding Durant Partners LLC, Mr. Udelhofen worked from 2006 to April 2016 at Water Street Capital, a multi-billion-dollar private investment firm in Jacksonville, Florida. Prior to joining Water Street Capital, Mr. Udelhofen researched businesses at growth-oriented mutual fund, Fred Alger Management. Prior to his services at Fred Alger Management, Mr. Udelhofen worked at Needham & Company, where he provided strategic insights to publicly traded companies, several initial public offerings and secondary offerings. He previously served on the board of managers of Durant Partners LLC.

Mr. Udelhofen’s extensive leadership experience, his investment expertise, his background of providing strategic insights to publicly traded companies and his involvement with initial public offerings and secondary