0001825088DEF 14Afalse00018250882022-01-012022-12-31iso4217:USD00018250882021-01-012021-12-3100018250882020-01-012020-12-310001825088dfh:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2022-01-012022-12-310001825088dfh:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2022-01-012022-12-310001825088dfh:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-01-012022-12-310001825088dfh:EquityAwardsGrantedDuringTheYearVestedFairValueMemberecd:PeoMember2022-01-012022-12-310001825088dfh:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310001825088dfh:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2022-01-012022-12-310001825088dfh:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2021-01-012021-12-310001825088dfh:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2021-01-012021-12-310001825088dfh:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-01-012021-12-310001825088dfh:EquityAwardsGrantedDuringTheYearVestedFairValueMemberecd:PeoMember2021-01-012021-12-310001825088dfh:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310001825088dfh:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2021-01-012021-12-310001825088dfh:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2020-01-012020-12-310001825088dfh:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2020-01-012020-12-310001825088dfh:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-01-012020-12-310001825088dfh:EquityAwardsGrantedDuringTheYearVestedFairValueMemberecd:PeoMember2020-01-012020-12-310001825088dfh:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310001825088dfh:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2020-01-012020-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedDuringTheYearVestedMember2022-01-012022-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedDuringTheYearVestedFairValueMember2022-01-012022-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedDuringTheYearVestedMember2021-01-012021-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedDuringTheYearVestedFairValueMember2021-01-012021-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedDuringTheYearVestedMember2020-01-012020-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedDuringTheYearVestedFairValueMember2020-01-012020-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001825088ecd:NonPeoNeoMemberdfh:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-31000182508812022-01-012022-12-31000182508822022-01-012022-12-31000182508832022-01-012022-12-31000182508842022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

| | | | | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

DREAM FINDERS HOMES, INC.

(Exact name of registrant as specified in its charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

From our Chairman & CEO

Dear Fellow Shareholders,

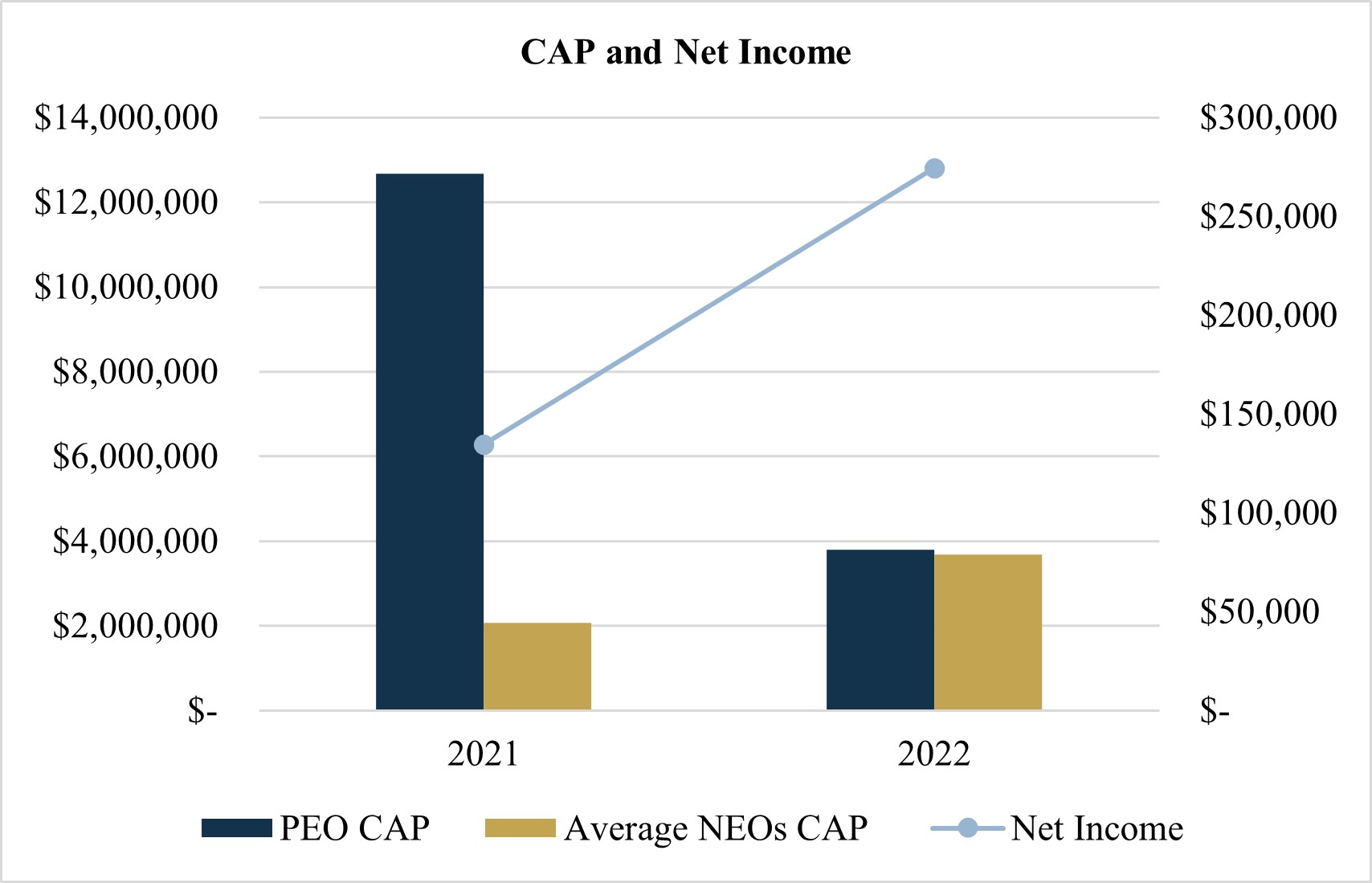

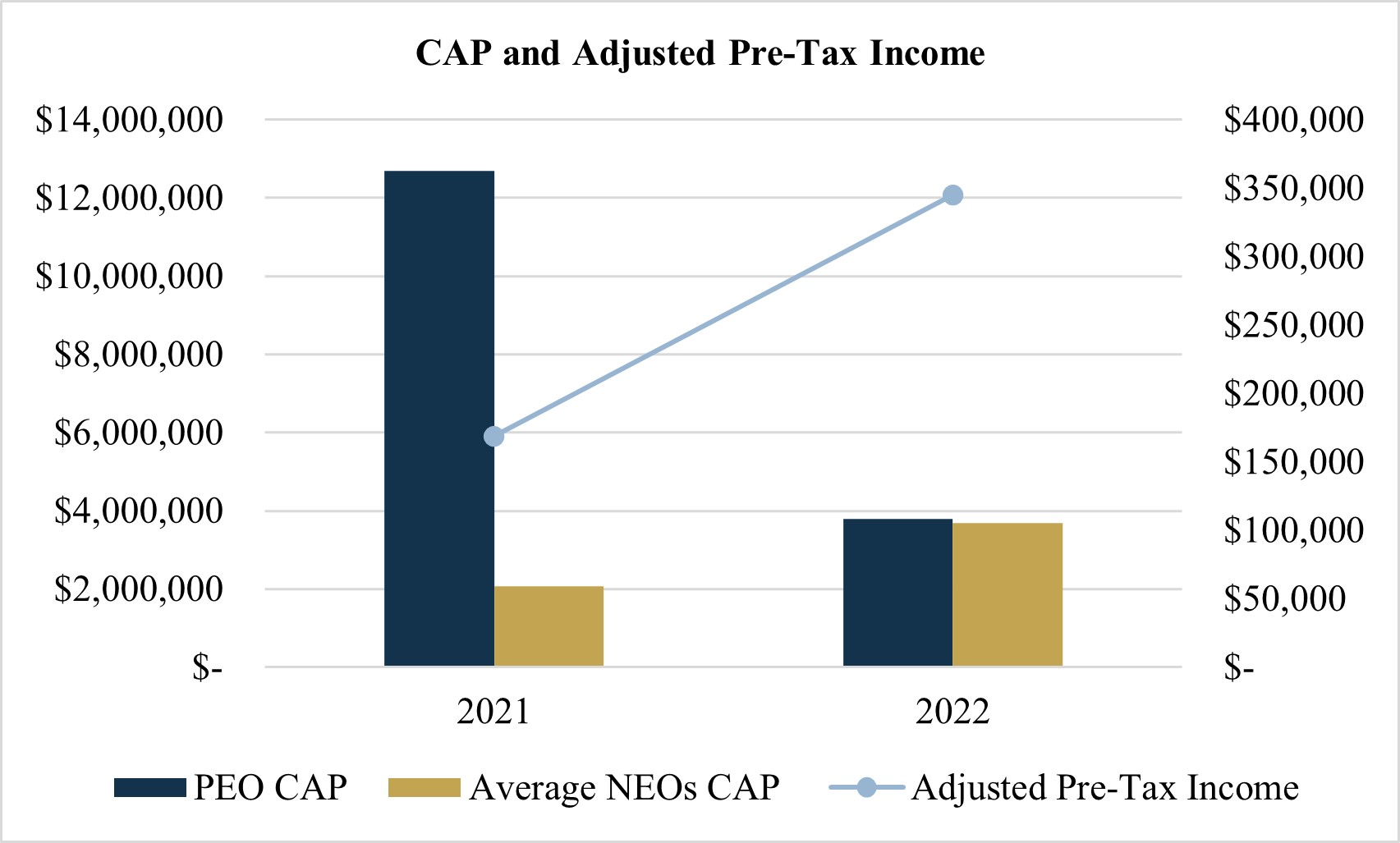

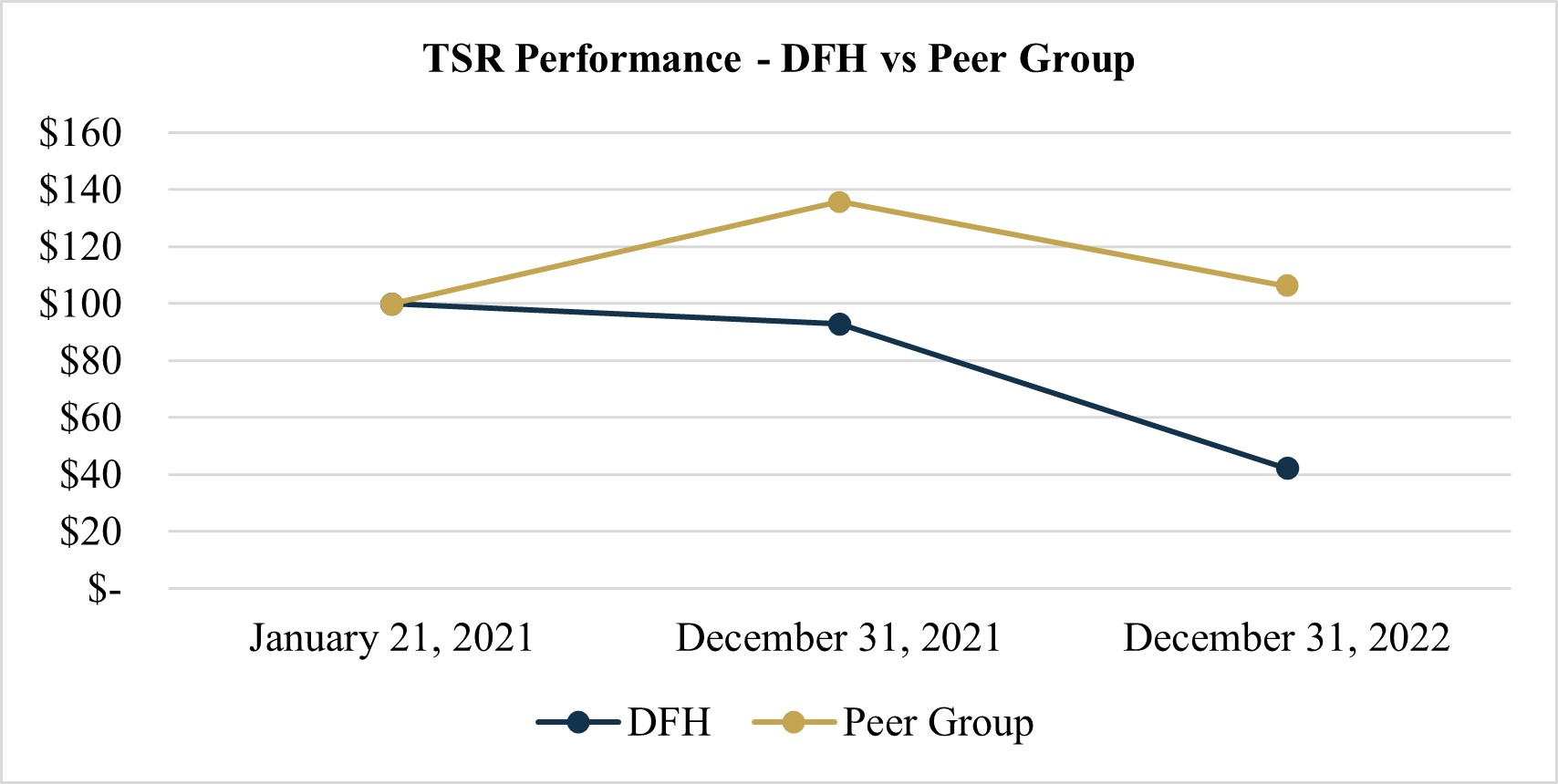

2022 concluded our 14th year of business and our second as a public company. Our record results for the year included top line revenue growth of 74% to $3.3 billion, supported by closings of 6,878 homes, representing a 41% increase in deliveries over the prior year. Our return on participating equity for the year was 49.1%, a metric we are particularly proud of as it demonstrates the efficacy of our asset-light model and remains in line with our record levels. Our 2022 full year concluded with pretax income of $356 million, net income of $262 million and basic earnings per share of $2.67, all annual records. Our results are a testament to our team’s dedication, persistence and execution.

The housing market was considerably challenged in the second half of 2022, impacted by the rapid rise in mortgage interest rates, persistent inflation and economic uncertainty. Our Company quickly adapted to the changing market conditions during this period. Our disciplined land-light strategy and diligent underwriting allowed us to strengthen our balance sheet as we accumulated record operating cash of $365 million and had total available liquidity of $487 million at year-end 2022. We remain opportunistic as we continuously assess opportunities to generate long-term value for the Company and our shareholders.

My full thoughts on 2022 and the year ahead will be included in my forthcoming annual letter, which will be accessible on the Company’s Investor Relations website.

About Dream Finders Homes, Inc.

Dream Finders Homes is one of the nation’s fastest growing homebuilding companies, with industry leading returns on shareholders’ equity. Dream Finders Homes is headquartered in Jacksonville, Florida and builds homes in Florida, Texas, North Carolina, South Carolina, Georgia, Colorado, and the Washington, D.C. metropolitan area (“DC Metro”), which includes Northern Virginia and Maryland. Dream Finders Homes achieves its industry leading growth and returns by maintaining an asset light homebuilding model. As of December 31, 2022 we operated in 8 states, as depicted below.

14701 Philips Highway, Suite 300

Jacksonville, Florida 32256

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

to be held on:

May 22, 2023

10:00 a.m., Eastern Time

Dear Stockholder:

You are cordially invited to attend our 2023 Annual Meeting of Stockholders, which will be held at 10:00 a.m., Eastern Time, on May 22, 2023 (the “Annual Meeting”), at our headquarters located at 14701 Philips Highway, Jacksonville, Florida 32256 in Suite 300.

We are holding the Annual Meeting for the following purposes, which are more fully described in the accompanying proxy statement:

1. To elect the nominees named in the accompanying proxy statement to our Board of Directors;

2. To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023;

3. To approve, in a non-binding vote, an advisory resolution approving executive compensation for fiscal year 2022; and

4. To transact such other business as may properly come before the Annual Meeting, or any adjournment thereof.

Only stockholders of record as of the close of business on March 27, 2023 are entitled to notice and to vote at the Annual Meeting or any adjournment thereof. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at our headquarters during the 10-day period prior to the Annual Meeting. If you would like to view this stockholder list, please contact Investor Relations at investors@dreamfindershomes.com.

Each share of our Class A common stock entitles the holder thereof to cast one vote on each matter brought before the Annual Meeting and each share of our Class B common stock entitles the holder thereof to cast three votes on each matter brought before the Annual Meeting. Your vote as a stockholder of Dream Finders Homes, Inc. is very important. If you are a registered stockholder and have questions regarding your stock ownership, you may contact our transfer agent, Broadridge Corporate Issuer Solutions, Inc., by email at shareholder@broadridge.com, through its website at www.broadridge.com or by phone at 1-844-998-0339 (within the U.S. and Canada) or 1-303-562-9304 (outside the U.S. and Canada).

Our Board of Directors has approved the proposals described in the accompanying proxy statement and recommends that you vote:

FOR the election of all nominees for director in Proposal 1;

FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 in Proposal 2; and

FOR the approval of the executive compensation for fiscal year 2022 in Proposal 3.

BY ORDER OF THE BOARD OF DIRECTORS

Robert E. Riva

Vice President, General Counsel and Corporate Secretary

Jacksonville, Florida

April 11, 2023

YOUR VOTE IS IMPORTANT

Instructions for submitting your proxy are provided in the Notice of Internet Availability of Proxy Materials, the accompanying proxy statement and your proxy card. It is important that your shares of our common stock be represented and voted at the Annual Meeting. Please submit your proxy through the Internet, by telephone or by completing the proxy card. You may revoke your proxy at any time prior to its exercise at the Annual Meeting. Please do not return the proxy card if you are voting through the Internet or by telephone.

Important Notice Regarding the Availability of Proxy Materials for the Annual Stockholder Meeting to be Held on May 22, 2023:

The accompanying proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 are available for review online at www.proxyvote.com or https://investors.dreamfindershomes.com.

TABLE OF CONTENTS

DREAM FINDERS HOMES, INC.

2023 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

INFORMATION CONCERNING VOTING AND SOLICITATION

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board” or “Board of Directors”) of Dream Finders Homes, Inc. ( “Dream Finders,” the “Company” or “we”) for use at the Company’s 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Company’s headquarters located at 14701 Philips Highway, Jacksonville, Florida 32256, in Suite 300 on May 22, 2023, at 10:00 a.m., Eastern Time, and any adjournment thereof.

On or about April 11, 2023, we will mail to our stockholders of record and beneficial owners a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) containing instructions on how to access this proxy statement (this “Proxy Statement”) and our Annual Report on Form 10-K for the year ended December 31, 2022 (our “2022 Annual Report”), and how to vote online, via the Internet. The Notice of Internet Availability will also contain instructions on how you can receive a paper copy of the proxy materials. Our 2022 Annual Report, Notice of Internet Availability and the proxy card are first being made available online on or about April 11, 2023.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What is the purpose of the Annual Meeting?

At the Annual Meeting, our stockholders will act upon the proposals described in this Proxy Statement.

What proposals are scheduled to be voted on at the Annual Meeting?

Our stockholders will be asked to vote on the following proposals:

| | | | | |

| Proposal 1: | To elect Patrick O. Zalupski, Megha H. Parekh, W. Radford Lovett II, Justin W. Udelhofen, Leonard M. Sturm and William W. Weatherford to the Board until our next annual meeting of stockholders, until such director’s successor is elected or appointed and qualified or until such director’s earlier death, resignation or removal; |

| Proposal 2: | To ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; |

| Proposal 3: | To approve, in a non-binding vote, an advisory resolution approving executive compensation for fiscal year 2022; and |

To transact such other business as may properly come before the Annual Meeting, or any adjournment thereof.

We are not aware of any other business to be brought before the Annual Meeting. If any additional business is properly brought before the Annual Meeting, proxies will be voted on those matters in accordance with the judgment of the person or persons acting under the proxies.

What is the recommendation of the Board on each of the proposals scheduled to be voted on at the Annual Meeting?

The Board recommends that you vote:

•FOR the election of each of the nominees for director named in Proposal 1;

•FOR the ratification of the appointment of PwC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 in Proposal 2; and

•FOR the approval of executive compensation for fiscal year 2022.

Voting of Proxies

When you vote by proxy, you authorize our officers listed on the proxy card to vote your shares of our common stock on your behalf as you direct. In the absence of such direction, your shares will be voted:

•FOR the election of each of the nominees for director named in Proposal 1;

•FOR the ratification of the appointment of PwC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 in Proposal 2; and

•FOR the approval of executive compensation for fiscal year 2022 in Proposal 3.

Voting and Ownership of Shares

At the close of business on the record date, March 27, 2023, the Company had 32,775,526 shares of Class A common stock outstanding and entitled to vote and 60,226,153 shares of Class B common stock outstanding and entitled to vote. Each share of our Class A common stock is entitled to one vote, and each share of our Class B common stock is entitled to three votes, on each matter brought before the Annual Meeting. The Class A common stock and Class B common stock vote together as a single class on all matters. The following votes are required to approve each of the proposals at the Annual Meeting.

•Election of Directors. Proposal 1 regarding the election of directors requires the approval of a plurality of the shares of our common stock entitled to vote at the Annual Meeting that are present in person, by remote communication or by proxy at the Annual Meeting that are voted on Proposal 1. This means that the six nominees receiving the highest number of affirmative FOR votes will be elected as directors.

•Ratification of the Appointment of Independent Registered Public Accounting Firm. Proposal 2 regarding the ratification of the appointment of PwC as the Company’s independent registered public accounting firm requires the approval of a majority of the shares of our common stock entitled to vote at the Annual Meeting that are present in person, by remote communication or by proxy at the Annual Meeting.

•Non-binding Advisory Vote on Executive Compensation for Fiscal Year 2022. Proposal 3 regarding the non-binding advisory resolution approving executive compensation for fiscal year 2022 requires the approval of a majority of the shares of our common stock entitled to vote at the Annual Meeting that are present in person, by remote communication or by proxy at the Annual Meeting. Although this advisory vote is non-binding, our Board and Compensation Committee will review the voting results and take them into account when considering future executive compensation arrangements.

Who can vote at the Annual Meeting?

Stockholders as of the close of business on the record date for the Annual Meeting (March 27, 2023) are entitled to vote at the Annual Meeting. At the close of business on the record date, there were 32,775,526 shares of our Class A common stock outstanding and entitled to vote and 60,226,153 shares of our Class B common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, at the close of business on the record date for the Annual Meeting (March 27, 2023), your shares of our common stock were registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., then you are considered the stockholder of record with respect to those shares.

As a stockholder of record, you may vote at the Annual Meeting or vote by proxy. Regardless of whether you plan to attend the Annual Meeting, we urge you to vote over the Internet, by telephone or, if you request paper proxy materials, by filling out and returning the proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee

If, at the close of business on the record date for the Annual Meeting (March 27, 2023), your shares of our common stock were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares of our common stock held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares of our common stock held in your account, and your nominee has enclosed or provided voting instructions for you to use in directing it on how to vote your shares of our common stock. However, the organization that holds your shares of our common stock is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares of our common stock at the Annual Meeting unless you request and obtain a valid proxy from the organization that is the record stockholder of your shares of our common stock giving you the right to vote the shares of our common stock at the Annual Meeting.

How do I vote?

If you are a stockholder of record at the close of business on the record date for the Annual Meeting (March 27, 2023), you may:

•vote in person—we will provide a ballot to any such stockholders who attend the Annual Meeting and wish to vote in person;

•vote by mail—if you request a paper proxy card, simply complete, sign and date the proxy card, then follow the instructions on the proxy card; or

•vote via the Internet or via telephone—follow the instructions on the Notice of Internet Availability or proxy card and have the Notice of Internet Availability or proxy card available when you access the website or place your telephone call.

Votes submitted via the Internet or by telephone must be received by 11:59 p.m., Eastern Time, on May 21, 2023. Submitting your proxy, whether via the Internet, by telephone or by mail, if you requested a paper proxy card, will not affect your right to vote at the Annual Meeting if you were a stockholder of record as of the close of business on the record date for the Annual Meeting (March 27, 2023), should you decide to attend the Annual Meeting and vote your shares of our common stock at the Annual Meeting. If you are not a stockholder of record as of the close of business on the record date for the Annual Meeting (March 27, 2023), you may still attend the Annual Meeting if you have already voted by proxy.

If you are not a stockholder of record as of the close of business on the record date for the Annual Meeting (March 27, 2023), please refer to the voting instructions provided by your nominee to direct it how to vote your shares of our common stock.

Your vote is important. Regardless of whether you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted.

How do I revoke my proxy?

A stockholder giving a proxy has the power to revoke it at any time before it is voted by providing written notice to the Corporate Secretary of the Company, by delivering a later-dated proxy or by voting during the Annual Meeting.

What is the quorum requirement for the Annual Meeting?

A majority in voting power of the outstanding shares of our Class A and B common stock (as a single class) as of the record date must be present in person, by remote communication or by proxy at the Annual Meeting in order to hold the Annual Meeting and conduct business. This presence is called a quorum.

How are votes counted?

An automated system administered by Broadridge Financial Solutions, Inc. (“Broadridge”) will tabulate stockholder votes submitted by proxy instructions submitted by beneficial owners over the Internet, by telephone or by proxy cards mailed to Broadridge. Broadridge will also tabulate stockholder votes submitted by proxies submitted by stockholders of record. Also, as the inspector of elections for the Annual Meeting, Broadridge will tabulate votes cast at the 2023 Annual Meeting.

How are abstentions and broker non-votes treated?

Abstentions (shares of our common stock present at the Annual Meeting that voted “abstain”) are counted for purposes of determining whether a quorum is present at the Annual Meeting and have no effect on the election of directors (Proposal 1). Abstentions will be counted toward the tabulation of the shares of our common stock entitled to vote at the Annual Meeting and will have the same effect as a negative vote on the ratification of the appointment of auditors (Proposal 2) and the advisory vote on 2022 executive compensation (Proposal 3).

Broker non-votes occur when shares of our common stock held by a broker, bank or other nominee for a beneficial owner are not voted either because (i) the broker, bank or other nominee did not receive voting instructions from the beneficial owner or (ii) the broker, bank or other nominee lacked discretionary authority to vote such shares. Broker non-votes are counted for purposes of determining whether a quorum is present and have no effect on the matters voted upon. Note that if you are a beneficial holder and do not provide specific voting instructions to your broker, bank or other nominee, the broker, bank or other nominee that holds your shares of our common stock will not be authorized to vote on the election of directors (Proposal 1) or on the advisory vote on 2022 executive compensation (Proposal 3). Ratification of the appointment of auditors (Proposal 2) is considered to be a routine matter and, accordingly, if you do not instruct your broker, bank or other nominee on how to vote the shares of our common stock in your account for Proposal 2, such broker, bank or other nominee will be permitted to exercise its discretionary authority to vote on the ratification of the appointment of auditors. Accordingly, we encourage you to provide voting instructions to your broker, bank or other nominee, regardless of whether you plan to attend the Annual Meeting.

What if I return a proxy card, but do not make specific choices?

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares of our common stock should be voted on a particular proposal at the Annual Meeting, your shares of our common stock will be voted in accordance with the recommendations of the Board of Directors stated above.

If you do not vote and you hold your shares of our common stock in street name, and your broker, bank or other nominee does not have discretionary power to vote your shares of our common stock, your shares may constitute “broker non-votes” (as described above). Shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the Annual Meeting. Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting.

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the SEC, the Company uses the Internet as the primary means of furnishing proxy materials to stockholders of record as of the record date for the Annual Meeting (March 27, 2023). Accordingly, on or about April 11, 2023, the Company will mail a Notice of Internet Availability to the Company’s stockholders. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice of Internet Availability or request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice of Internet Availability and www.proxyvote.com. The Notice of Internet Availability also contains instructions on how to receive, free of charge, paper copies of the proxy materials. If you received the Notice of Internet Availability, then you will not receive paper copies of the proxy materials unless you request them. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce cost to the Company associated with the physical printing and mailing of proxy materials.

How can I get electronic access to the proxy materials?

The Notice of Internet Availability will provide you with instructions regarding how to use the Internet to:

•View the Company’s proxy materials for the Annual Meeting; and

•Instruct the Company to send future proxy materials to you by email.

The Company’s proxy materials are also available at https://www.investors.dreamfindershomes.com. This website address is included for reference only. The information contained on the Company’s website is not incorporated by reference into this Proxy Statement.

Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

Who is paying for this proxy solicitation?

The Company is paying the costs of the solicitation of proxies. Proxies may be solicited on behalf of the Company by our directors, officers, employees or agents in person or by telephone or other electronic means. We will also reimburse brokerage firms and other custodians, nominees and fiduciaries, upon request, for their reasonable expenses incurred in sending proxies and proxy materials to beneficial owners of our common stock. We have not retained an outside proxy solicitation firm to assist us with the solicitation of proxies.

PROPOSAL 1-ELECTION OF DIRECTORS

Our Amended and Restated Certificate of Incorporation (our “Certificate of Incorporation”) provides that the number of directors on the Board will be no less than three, as established from time to time by resolution of the Board. The Board currently has set the size of the Board at seven members, and following the 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”), the Board size will be set at six members. Each person listed below has been nominated to be re-elected to hold office as a director for a one-year term ending at the Company’s 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) and until his or her successor is duly elected or appointed and qualified or, if earlier, such nominee’s earlier death, resignation or removal. Following a discussion with Mr. Walton about his desire to reduce his overall time commitment to board service, in general, the Board did not re-nominate William H. Walton III for director. Accordingly, his term as director will expire at the 2023 Annual Meeting. Mr. Walton has been a valuable member of the Company’s Board of Directors and the Company wishes him the best in his future endeavors.

Each nominee listed below currently serves on the Board, has consented to being named as a nominee for election and has indicated an intention to continue to serve on the Board if re-elected. The Board does not anticipate that any nominee will be unable to serve as a director, but, in the event that any such nominee is unable to serve as a director or should otherwise become unavailable, the Board may either elect to reduce the size of the Board or propose an alternate nominee, in which case the proxies will be voted for the alternate nominee unless directed to withhold from voting.

There are no familial relationships among our directors and executive officers.

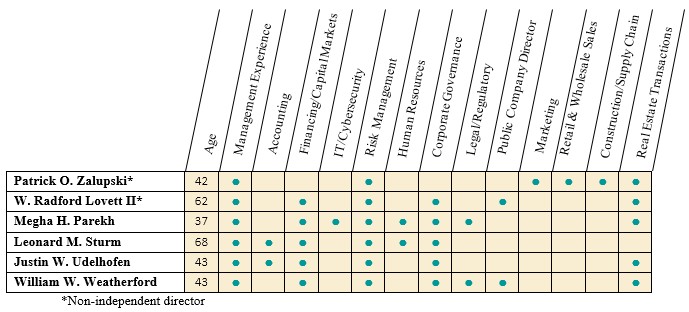

Director Nominees

The Board of Directors believes that it is necessary for its members to possess qualities, attributes and skills that contribute to a diverse range of views and perspectives among the directors and enhance the overall effectiveness of the Board. As prescribed in its committee charter and described further under “Corporate Governance and Director Independence—Selection and Evaluation of Director Candidates,” our Nominating and Governance Committee (the “Nominating and Governance Committee”) considers all factors it deems relevant when evaluating prospective candidates or current board members for nomination to the Board of Directors. The Board is comprised of highly qualified individuals with unique and special skills that assist in effective management of the Company for the benefit of our stockholders.

Each of our directors possesses certain experience, qualifications, attributes and skills, as further described below, that led to our conclusion that he or she should serve as a member of the Board.

Directors’ Experience and Skills

Directors’ Biographies

Patrick O. Zalupski President, Chief Executive Officer, Director

Mr. Zalupski, age 42, is our President and Chief Executive Officer and has served as Chairman of the Board of Directors since January 2021. He has served as the Chief Executive Officer of our primary operating subsidiary, Dream Finders Homes LLC, a Florida limited liability company (“DFH LLC”), since forming the company in December 2008, and as the Chief Executive Officer and a member of the board of managers of DFH LLC since its formation in 2014. He is responsible for our overall operations and management and is heavily involved in the origination, underwriting and structuring of all land investment activities. Under Mr. Zalupski’s leadership, we have grown from closing 27 homes in Jacksonville, Florida during our inaugural year in 2009 to establishing operations in markets across the state of Texas and the Southeast, Mid-Atlantic and Mountain Regions of the United States and closing over 22,200 homes since our inception through the end of 2022. Prior to founding DFH LLC, Mr. Zalupski was a Financial Auditor for FedEx Corporation’s Internal Audit Department in Memphis, Tennessee and worked in the real estate sales and construction industry as Managing Partner of Bay Street Condominiums, LLC from 2006 to 2008. He has served on the investment committee of DF Capital Management, LLC, a Florida limited liability company (“DF Capital”), an investment manager focused on investments in land banks and land development joint ventures to deliver finished lots to us and other homebuilders for the construction of new homes, since April 2018 and on the board of directors for our mortgage banking joint venture, Jet Home Loans, LLC, a Florida limited liability company, since December 2017. Mr. Zalupski holds an inactive Florida Real Estate License.

Mr. Zalupski brings extensive leadership, along with industry and operational experience to the Board of Directors. Through his experience, his knowledge of our operations and our markets and his professional relationships within the homebuilding industry, Mr. Zalupski is highly qualified to identify important matters for review and deliberation by the Board of Directors and is instrumental in determining our corporate strategy. In addition, by serving as both the Chairman of the Board and our Chief Executive Officer, Mr. Zalupski serves as an invaluable bridge between our management and the Board of Directors and ensures that both parties act with a common purpose.

Mr. Zalupski’s financial acumen, extensive industry experience and demonstrated leadership capabilities throughout our growth as a Company make him highly qualified to continue to serve as our Chairman of the Board.

W. Radford Lovett II Director

Mr. Lovett, age 62, has served as a member of the Board of Directors since January 2021. He has also served on the board of managers of DFH LLC from December 2014 to January 2021. Mr. Lovett was the founder, chairman and chief executive officer of two highly successful growth companies: TowerCom, Ltd, an owner and developer of broadcast communication towers that he founded in 1994, and TowerCom Development, LP, a developer of wireless communications infrastructure that he founded in 1997. TowerCom, Ltd and TowerCom Development, LP have each generated over 90% compounded annual rates of return for their investors. In 2007, he founded TowerCom, LLC and has since served as its chairman and chief executive officer. Mr. Lovett also co-founded Lovett Miller & Co. in 1997, a venture capital firm that focuses in technology-enhanced services and healthcare companies. Prior to co-founding Lovett Miller & Co., he served as the president of Southcoast Capital Corporation, a family holding company that invests in private equities, public equities and real estate. Prior to serving as president of Southcoast Capital Corporation, Mr. Lovett worked for the Lincoln Property Company and in the corporate finance department of Merrill Lynch. Mr. Lovett has made venture capital investments in the following companies: RxStrategies, Inc., EverBank Financial Corporation, Healthcare Solutions, Inc. (formerly Cypress Care, Inc.), CareAnywhere, Inc., K&G Men’s Centers, Inc., Sigma International Medical Apparatus, Go Software, Inc., Main Bank Corporation, PowerTel, Inc. and Southcoast Boca Associates.

He currently serves on the board of directors of the following companies: TowerCom, LLC. Mr. Lovett also currently serves on the board of directors for Florida Prepaid College Board. Mr. Lovett previously served on the board of trustees and was co-chairman of the Capital Campaign for the University of North Florida. Mr. Lovett also previously served on the board of directors of EverBank Financial Corporation (formerly a publicly traded company) and was the chairman of the Youth Crisis Center and the Jacksonville Jaguars Honor Rows Program.

Mr. Lovett’s extensive experience serving on boards of directors and 25 years of executive leadership experience and management experience make him qualified to serve on the Board of Directors. Mr. Lovett is the chair of our Compensation Committee and a member of our Nominating and Governance Committee.

Megha H. Parekh Director

Ms. Parekh, age 37, has served as a member of the Board of Directors since January 2021. In 2013, Ms. Parekh joined the Jacksonville Jaguars, a professional football franchise based in Jacksonville, Florida, as Vice President and General Counsel and, in 2016, was promoted to her current position as Senior Vice President and Chief Legal Officer. Ms. Parekh manages the legal, technology, security, capital improvements and people development teams at the Jacksonville Jaguars. Since joining the Jacksonville Jaguars, Ms. Parekh has also worked on a number of other acquisitions and business ventures for Shad Khan, the Jacksonville Jaguars’ owner, including serving as Chief Legal Officer for Iguana Investments Florida, LLC and Chief Legal Officer for All Elite Wrestling, LLC. Prior to joining the Jacksonville Jaguars, Ms. Parekh worked in the New York office of the international law firm Proskauer Rose LLP, where she practiced corporate law and worked on public and private acquisitions and financings and securities offerings. Ms. Parekh currently serves on the board of directors of the Jacksonville Jaguars Foundation, Inc. and the Florida Sports Foundation, Inc. and on the board of managers of the Black News Channel, an American broadcast television news channel based in Tallahassee, Florida targeting the African American demographic.

Ms. Parekh’s 12 years of experience in acquisitions and business ventures and her legal expertise make her qualified to serve on the Board of Directors. Ms. Parekh is the chair of our Nominating and Governance Committee and a member of our Audit Committee and our Compensation Committee.

Leonard M. Sturm Director

Mr. Sturm, age 68, has served as a member of the Board of Directors since September 30, 2022. Mr. Sturm retired at the end of 2014 as an audit partner in the New York office of KPMG LLP (“KPMG”) after a thirty-seven year career conducting financial statement audits of primarily public companies and audits of internal controls under Section 404 of the Sarbanes-Oxley Act. He was a member of the New York audit leadership team for a number of years through 2012, and subsequently joined KPMG’s department of professional practice, assuming certain national responsibilities for KPMG’s quality review process until his retirement. Mr. Sturm also served as a member of KPMG’s audit committee for three years. During his tenure at KPMG, Mr. Sturm authored the annual “Metropolitan New York Regional Software Industry Outlook”, which provided comprehensive industry analysis and benchmarking data. Mr. Sturm was also a founder and treasurer on the board of directors of LISTnet, was the chairman of the board of directors for the Long Island Software and Technology Incubator, served as the treasurer on the board of directors of Gold Coast Villas Association and served as a member on the board of directors of the Huntington Chamber of Commerce. He also served as president of the New York Chapter of the Association of Government Accountants, was a member on the defense contractor committee of the American Institute of CPA's and co-authored the “Government Contractors Industry Audit and Accounting Guide.”

Mr. Sturm currently serves as a member of the board of directors and chairman of the audit committee of Jolley Holding Aruba, which consists of numerous companies that primarily operate in commercial real estate, car dealership, car rental, retail and wholesale businesses.

In that capacity, Mr. Sturm assists in board oversight of the integrity of the financial statements, the monitoring and management of financial risks, the effectiveness of internal financial controls, compliance with regulatory requirements and the work of the independent auditors and the internal audit function.

Mr. Sturm's extensive leadership experience, his audit experience and his experience as a member of, or advisor to, boards, makes him qualified to serve on the Board of Directors. Mr. Sturm is the Chair of our Audit Committee and a member of the Nominating and Governance Committee. The Board of Directors has determined that Mr. Sturm qualifies as an “audit committee financial expert,” as such term is defined in Item 407(d) of Regulation S-K.

Justin W. Udelhofen Director

Mr. Udelhofen, age 43, has served as a member of the Board of Directors since January 2021. He also served on the board of managers of DFH LLC from December 2014 to January 2021. Mr. Udelhofen has been a private investor since July 2020. He previously founded Durant Partners LLC in October 2016, an investment fund that focuses on small-to-mid-capitalization equities, and served as Principal until June 2020. Prior to founding Durant Partners LLC, Mr. Udelhofen worked from 2006 to April 2016 at Water Street Capital, a multi-billion-dollar private investment firm in Jacksonville, Florida. Prior to joining Water Street Capital, Mr. Udelhofen researched businesses at growth-oriented mutual fund, Fred Alger Management. Prior to his services at Fred Alger Management, Mr. Udelhofen worked at Needham & Company, where he provided strategic insights to publicly traded companies, several initial public offerings and secondary offerings. He previously served on the board of managers of Durant Partners LLC.

Mr. Udelhofen’s extensive leadership experience, his investment expertise, his background of providing strategic insights to publicly traded companies and his involvement with initial public offerings and secondary offerings make him qualified to serve on the Board of Directors. Mr. Udelhofen is a member of our Audit Committee, Nominating and Governance Committee and Compensation Committee.

William W. Weatherford Director

Mr. Weatherford, age 43, brings more than two decades of governance, financial and risk management expertise to the Company’s Board. He is currently managing partner of Weatherford Capital, which he co-founded in 2015 to build and invest in businesses that positively impact the world. In 2012, prior to the founding of Weatherford Capital, Mr. Weatherford made history as the 84th Speaker of the Florida House of Representatives becoming the youngest presiding officer of any state legislative chamber in the United States at the time.

Mr. Weatherford served in the Florida Legislature from 2006 until 2014 and used his position as Speaker to advocate for social mobility through free enterprise and education reform and focused his tenure on breaking the cycle of generational poverty. Mr. Weatherford currently serves as chairman of the University of South Florida’s board of trustees. Mr. Weatherford also recently served as co-chairman of the host committee for Super Bowl LV in Tampa, Florida. In addition to chairing the board at the University of South Florida, Mr. Weatherford currently serves on the boards of TECO Energy, Kitson & Partners, PayIt, SOMA Global, The Florida Council of 100, and The National Council for the American Enterprise Institute. Mr. Weatherford also has previous public company board experience from his directorships with Sunshine Bancorp, Inc. from 2015 to 2018 and Mallard Acquisition Corp. from 2020 to 2022.

Mr. Weatherford’s extensive political, investment and management expertise and his previous experience of serving on public boards make him qualified to serve on the Board of Directors.

Required Vote

The proposal regarding the election of directors requires the approval of a plurality of the shares of our common stock entitled to vote at the Annual Meeting that are present in person, by remote communication or by proxy at the Annual Meeting that are voted on this proposal. This means that the six nominees receiving the highest number of affirmative FOR votes will be elected as directors of the Company. Broker non-votes will have no effect on the outcome of the vote on this proposal. If you own shares of our common stock through a broker, bank or other nominee, you must instruct your broker, bank or other nominee how to vote in order for such broker, bank or other nominee to vote your shares so that your vote can be counted on this proposal.

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE

FOR EACH OF THE NOMINATED DIRECTORS.

PROPOSAL 2-RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

PwC was the Company’s independent registered public accounting firm for the year ended December 31, 2022. At the Annual Meeting, our stockholders will be asked to ratify the appointment of PwC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023, or until such firm’s earlier resignation or removal. While stockholder ratification of the appointment of the Company’s independent registered public accounting firm is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice. Even if the appointment of PwC is ratified, our Audit Committee retains the discretion to select and appoint a different independent registered public accounting firm at any time if it determines that such a change would be in the best interest of the Company.

We have been advised that a representative of PwC will be present at the Annual Meeting to answer appropriate questions and to have an opportunity to make a statement, if desired.

Fees Paid to PwC

The following table shows the fees paid or accrued by the Company for the audit and other services provided by PwC for the years ended December 31, 2022 and 2021.

| | | | | | | | | | | |

| 2022 | | 2021 |

Audit Fees(1) | $ | 1,684,350 | | | $ | 1,395,000 | |

Audit-Related Fees – aggregate fees for audit-related services | — | | | — | |

Tax Fees(2) | 175,730 | | | 225,000 | |

All Other Fees – aggregate fees for all other services | — | | | — | |

| Total | $ | 1,860,080 | | | $ | 1,620,000 | |

(1) Audit Fees include the annual audit of the consolidated financial statements, the audit of the Company’s internal controls for 2022, services related to the review of quarterly financial information for both 2022 and 2021, and the issuance of consents and comfort letters to underwriters in connection with our IPO and filings with the SEC for 2021 and for comfort letter services in 2022.

(2) Tax Fees generally consist of fees for tax compliance and return preparation, and tax planning and advice.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services

It is our Audit Committee’s policy to pre-approve all audit, audit-related and permissible non-audit services rendered to us by our independent registered public accounting firm. The fees set forth in the tables above were pre-approved by our Audit Committee.

Report of the Audit Committee

Our Audit Committee meets the definition of an audit committee as set forth in the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and operates under a written charter adopted by the Board. Each member of our Audit Committee is independent and financially literate in the judgment of the Board and as required by the Sarbanes-Oxley Act of 2002, as amended, and applicable SEC and New York Stock Exchange (“NYSE”) rules. The Board has also determined that Mr. Sturm qualifies as an “audit committee financial expert,” as defined under SEC regulations.

Management is responsible for our internal controls and the financial reporting process. Our Audit Committee is responsible for the appointment, compensation and oversight of the Company’s independent registered public accounting firm.

PwC, the Company’s independent registered public accounting firm, is responsible for performing an independent audit of the Company’s consolidated financial statements and internal controls in accordance with standards of the Public Company Accounting Oversight Board (the “PCAOB”) and for issuing reports thereon.

Our Audit Committee has reviewed and discussed with management the Company’s audited consolidated financial statements for the year ended December 31, 2022. Further, our Audit Committee has discussed with PwC the matters required to be discussed by Auditing Standard No. 16, Communications with Audit Committees, including the Company’s audited consolidated financial statements for the year ended December 31, 2022, the Company’s independent registered public accounting firm’s responsibility under generally accepted auditing standards, significant accounting policies, management’s judgments and accounting estimates, any audit adjustments, related party transactions and other unusual transactions, other information in documents containing audited financial statements and other matters.

Finally, our Audit Committee has received and reviewed the written disclosures and the letter from PwC in accordance with the applicable requirements of the PCAOB regarding PwC’s communications with our Audit Committee concerning independence and has discussed the topic of independence with PwC.

Based on its review and discussion described above, our Audit Committee has recommended to the Board that the audited consolidated financial statements for the year ended December 31, 2022 be included in the 2022 Annual Report for filing with the SEC.

| | | | | | | | |

| Leonard M. Sturm (Chair) | |

| Megha H. Parekh | |

| Justin W. Udelhofen | |

The foregoing report is not soliciting material, is not deemed filed with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Required Vote

Ratification of the appointment of PwC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 requires the affirmative vote of a majority of the shares of our common stock entitled to vote at the Annual Meeting that are present in person, by remote communication or by proxy at the Annual Meeting. Abstentions will be counted toward the tabulation of the shares of our common stock entitled to vote at the Annual Meeting on the ratification of the appointment of PwC and will have the same effect as a negative vote.

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE

FOR THIS PROPOSAL.

PROPOSAL 3-NON-BINDING, ADVISORY VOTE ON

EXECUTIVE COMPENSATION

We are asking our stockholders to cast a non-binding advisory vote on the Company’s 2022 executive compensation as reported in this proxy statement.

We urge stockholders to read the “Compensation Discussion and Analysis” and "Executive Compensation" sections, the Summary Compensation Table and other related compensation tables and narrative in this proxy statement, which provide detailed information on the compensation of our named executive officers (“NEOs”).

In accordance with Section 14A of the Securities Exchange Act of 1934, as amended, and as a matter of good corporate governance, we are asking stockholders to approve the following advisory resolution:

RESOLVED, that the stockholders of Dream Finders Homes, Inc. (the “Company”) approve, on an advisory basis, the 2022 compensation of the Company’s NEOs disclosed in the Proxy Statement for the Company’s 2023 Annual Meeting of Stockholders.

Required Vote

Approval of the non-binding advisory resolution on executive compensation for 2022 requires the affirmative vote of a majority of the shares of our common stock entitled to vote at the Annual Meeting that are present in person, by remote communication or by proxy at the Annual Meeting. Abstentions will be counted toward the tabulation of the shares of our common stock entitled to vote at the Annual Meeting on the 2022 executive compensation approval and will have the same effect as a negative vote. Because this vote is advisory only, it will not be binding on the Compensation Committee. Although this advisory vote is non-binding, our Compensation Committee will review the voting results and take them into account when considering future executive compensation arrangements. Broker non-votes will have no effect on the outcome of the vote on this proposal. If you own shares of our common stock through a broker, bank or other nominee, you must instruct your broker, bank or other nominee how to vote in order for such broker, bank or other nominee to vote your shares so that your vote can be counted on this proposal.

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE

FOR THIS PROPOSAL.

CORPORATE GOVERNANCE AND DIRECTOR INDEPENDENCE

Corporate Governance Guidelines

The Board has adopted the Dream Finders Homes, Inc.’s Corporate Governance Guidelines (the “Corporate Governance Guidelines”), which describe the Board’s view on a number of governance topics. The Corporate Governance Guidelines, along with the charters of the Board committees and the Company’s Code of Business Conduct and Ethics (the “Code of Business Conduct and Ethics”), provide the framework for the corporate governance of the Company. The significant corporate governance initiatives adopted by the Board are discussed below. Our Corporate Governance Guidelines can be found under the “Investor Relations—Governance” link on our website at www.dreamfindershomes.com.

Composition of the Board

Our Certificate of Incorporation provides that the number of directors on the Board will be no less than three, as established from time to time by resolution of the Board. The Board currently has set the size of the Board at seven members and following the 2023 Annual Meeting, the Board size will be set at six members. Each director is elected to serve a one-year term and will hold office until his or her successor is duly elected or appointed and qualified or, if earlier, such nominee’s death, resignation or removal. In the event of a vacancy on the Board, such vacancy will be filled solely by the affirmative vote of a majority of our remaining directors then in office, and not by our stockholders. Each of our directors is elected annually.

Our Nominating and Governance Committee is responsible for conducting an annual review of the composition of the Board, including a review of the size and structure of the Board or any committee thereof, performing an annual performance evaluation of the effectiveness of the Board and its committees and identifying any opportunities for improvement with respect to the Board’s performance. The findings of such annual review and evaluation are presented to and discussed with the full Board.

Selection and Evaluation of Director Candidates

Our Nominating and Governance Committee is responsible for identifying and recommending individuals who are qualified to become members of the Board and for filling vacancies that may arise on the Board. To facilitate the search process, our Nominating and Governance Committee may obtain the advice of, or retain the services of, outside legal counsel and such other advisors, including director search firms, as it deems necessary to help identify qualified candidates. Our Nominating and Governance Committee may also consider director candidates recommended by our stockholders. Our Nominating and Governance Committee seeks to identify a diverse slate of potential candidates, consisting of diverse skills, expertise, backgrounds and experiences, among other factors. Our Nominating and Governance Committee is also responsible for developing and recommending to the Board the standards to be applied when evaluating potential candidates’ independence from the Company and potential conflicts of interest, to aide the Board when determining whether a candidate is suitable for election as director.

Our Nominating and Governance Committee annually reviews and evaluates with the Board the appropriate skills and experience required for the Board, as a whole, and its individual members. In such evaluation and resulting recommendation of director candidates, our Nominating and Governance Committee will consider such factors and criteria as it deems appropriate, including such director candidate’s judgment, skill, integrity, diversity and business or other experience.

We believe that diverse skills, expertise, backgrounds and experiences are important components of director qualifications and characteristics. These qualifications and characteristics are discussed further below.

Key Director Qualifications and Experiences

•Experience in corporate management, such as serving as an officer, former officer or other leadership role for a publicly held company or large private company;

•Experience as a board member of another publicly held company or large private company;

•Real estate industry professional and academic expertise, including homebuilding, land development, sales, marketing and operations;

•Experience in accounting, finance, capital markets transactions and/or technology;

•Legal, regulatory and/or risk management expertise; and

•Information technology and cybersecurity exposure or expertise.

Key Director Characteristics

•High personal and professional ethical standards, integrity and values;

•Strong leadership skills and solid business judgment;

•Commitment to representing the long-term interests of our stockholders;

•The time required for preparation, participation and attendance at Board meetings and committee meetings, as applicable; and

•Lack of potential conflicts of interest with other personal and professional pursuits.

We consider director candidates recommended by our stockholders in the same manner as those recommendations made by directors, executive officers, outside advisors or search firms. Pursuant to Article II, Section 2(b) of our Bylaws, any stockholder desiring to recommend a director candidate to our Nominating and Governance Committee for consideration should deliver written notice and the other required information to the Corporate Secretary of the Company. Any such notice should be delivered by the date required by such section of our Bylaws in order to permit our Nominating and Governance Committee to complete its review in a timely fashion.

Director Tenure and Retirement Policy

We have not established term limits for directors serving on the Board because we place a high value on having directors who are knowledgeable about the Company and its operations. Additionally, we have not established a mandatory retirement age for directors serving on the Board. In connection with the director nomination recommendations, however, our Nominating and Governance Committee and the Board will review each director candidate’s position on the Board upon reaching the age of 75 and each year thereafter.

The Board has also enacted a policy whereby each director (including a management director) of the Company must promptly offer to tender his or her resignation to the Board in the event of (i) a significant change in such director’s affiliation or position of principal employment or (ii) a disabling health condition if, in each case, such change adversely affects his or her ability to perform the essential functions and responsibilities as a director. Our Nominating and Governance Committee is responsible for reviewing how such change will impact the director’s qualification to continue to serve on the Board and making a recommendation to the Board on whether to accept or reject such resignation.

Election of Directors

In accordance with our Bylaws, the election of directors requires the approval of a plurality of the shares of our common stock entitled to vote at the Annual Meeting that are present in person, by remote communication or by proxy at the Annual Meeting that are voted on the election of directors. This means that the six nominees receiving the highest number of affirmative FOR votes at the Annual Meeting will be elected as directors. The Board believes that the plurality voting standard continues to be in the best interests of the Company and our stockholders; however, the Board will periodically re-evaluate the merits of a change to such voting standard.

Director Independence

In accordance with the NYSE listing requirements, the Board is composed of a majority of independent directors. The Board has determined that, with the exception of Messrs. Lovett and Zalupski, all members of the Board are independent. In making such determination, the Board affirmed that each of the independent directors meets the objective requirements for independence set forth by the NYSE listing requirements. The independent directors are Messrs. Udelhofen, Sturm, Walton and Weatherford and Ms. Parekh. Mr. Zalupski is not independent because he serves as our President and Chief Executive Officer. Mr. Lovett is not independent because he is the managing partner of several joint ventures that the Company formed with DFH Investors, LLC (“DFH Investors”) in 2017, which no longer conduct any business as of December 31, 2022.

The independence standards included in the NYSE listing requirements specify the criteria by which the independence of our directors is determined, including strict guidelines for directors and their immediate family members with respect to past employment or affiliation with the Company, its management or its independent registered public accounting firm.

In evaluating and determining the independence of our directors, the Board considered that the Company may have certain relationships with its directors. Specifically, the Board considered, among other things, the transactions described under “Certain Relationships and Related Party Transactions”.

CODE OF BUSINESS CONDUCT AND ETHICS

All of our employees, officers and directors, including those responsible for financial reporting, operate under a written Code of Business Conduct and Ethics. All employees are required, upon their initial employment with the Company and annually thereafter, to affirm in writing their receipt and review of the Code of Business Conduct and Ethics and their compliance with its provisions. Additionally, the Corporate Governance Guidelines prohibit directors and executive officers from entering into any form of hedging or other monetization transaction involving shares of our common stock.

The Code of Business Conduct and Ethics was adopted in January 2021 and can be accessed under the “Investor Relations—Governance” link on our website at www.dreamfindershomes.com. We intend to satisfy any disclosure requirements pursuant to Item 5.05 of Form 8-K and the NYSE rules regarding any amendment to, or waiver from, certain provisions of the Code of Business Conduct and Ethics by posting such information on our website.

Stockholder Engagement

Our executive management team expects to actively engage in communications throughout the year with stockholders of all ownership levels. Generally, these communications involve participating in investor presentations and question and answer sessions, meeting with investors and stockholders one-on-one and in small groups and responding to investor and stockholder letters, emails and telephone calls in accordance with blackout period restrictions.

Management’s discussions with stockholders and the investment community address numerous aspects of our business and matters of importance or concern to our stockholders. Observations, questions or comments from our stockholders are generally shared with the Board so that the Board can then consider these matters as part of its oversight responsibilities.

Complaint Procedures for Accounting, Internal Control, Auditing and Financial Matters

In accordance with SEC rules, our Audit Committee oversees the Company’s established procedures for the confidential, anonymous submission of complaints to the Company regarding (i) questionable accounting or auditing matters and internal controls and (ii) compliance with the Code of Business Conduct and Ethics. Our Audit Committee, in consultation with management and the Board, investigates such complaints and, if necessary, enforces the provisions of the Code of Business Conduct and Ethics. Anonymous complaints may be submitted by calling EthicsPoint at 1-844-964-1669 or by visiting http://dreamfindershomes.ethicspoint.com.

BOARD LEADERSHIP STRUCTURE AND BOARD’S ROLE IN RISK OVERSIGHT

Board Leadership Structure

The Board exercises discretion in combining or separating the roles of Chief Executive Officer and Chairman of the Board as it deems appropriate in light of prevailing circumstances. The Board believes that the combination or separation of these positions should continue to be considered as part of our succession planning process. The two roles are currently combined, with Mr. Zalupski serving as our Chief Executive Officer and Chairman of the Board. Mr. Zalupski’s financial acumen, extensive industry experience and demonstrated leadership capabilities throughout our growth as a Company make him highly qualified to continue to serve as our Chief Executive Officer and the Chairman of the Board.

Role in Risk Oversight

The Board is responsible for high-level oversight of our risk management process, but our executive management team is responsible for providing day-to-day risk management. The Board oversees management’s implementation of risk mitigation strategies to ensure that such strategies focus on both general risk management and management of the Company’s most significant risks. The Board also contributes to the mitigation of risk via its general oversight responsibilities and the requirement for the Board’s approval of corporate matters and significant transactions. Additionally, each committee of the Board is particularly responsible, as indicated in its respective charter, for risk management in its area of responsibility and such other areas of responsibility as may be delegated to it by the Board from time to time.

The risk management process established and overseen by the Company’s executive management team includes centralized corporate review of the market, real estate, financial, cybersecurity, supply chain and other risks associated with transactions and approval of funds disbursed.

Homebuilding Operations

Land and Lots. Our Land Acquisition Committee, consisting of Patrick O. Zalupski, our Chief Executive Officer and Chairman of the Board; J. Douglas Moran, our Chief Operations Officer; L. Anabel Fernandez, our Chief Financial Officer; Batey McGraw, our National Head of Land; Michelle Murrhee, our Director of Finance; Robert E. Riva, our General Counsel and Corporate Secretary; is responsible for the review, approval and eventual allocation of capital for the acquisition and development of land and lots to support our homebuilding operations. All new market expansion opportunities, however, are first discussed with the Board, which we believe adequately manages our risks related to our land and lot acquisitions.

Homebuilding. Our philosophy is to build homes efficiently, leveraging our industry-leading systems and processes and offering a set number of floor plans in each community with standardized features. Our experienced local management team serves as the general contractor for the homes we build, with centralized corporate oversight for purchasing, accounting, financing, budget variances, scheduling and overall community performance. Formally, on a quarterly basis, the Board is informed of the quarterly home closings by division. At each quarterly meeting, management reviews with Board members the operating results and home closings by division and market, as well as new potential markets and significant operational issues. Between quarterly meetings, the Board also communicates with management in-person or telephonically, on an ad hoc basis, as needed. We believe this involvement provides the Board with the appropriate information to provide sufficient oversight of our operating risks.

Financing and Liquidity

The Board oversees risk related to available capital and liquidity sources by routinely monitoring the Company’s key balance sheet metrics and capital and liquidity allocation framework to ensure that the Company has the necessary financial resources to fund its homebuilding operations, land and lot acquisition strategy, projected growth and any other operating expenses that may arise. Management provides Board members, at a minimum, at each quarterly meeting an overview of the Company’s financial and liquidity position, including projected short- and long-term liquidity needs, availability under the Company’s revolving credit facility and other capital sources. We believe these procedures provide adequate risk oversight of financing and liquidity matters affecting the Company.

Financial Reporting, Internal Control and Regulatory Compliance

Audit Committee Risk Oversight. Our Audit Committee reviews and oversees risk related to financial reporting, internal control over financial reporting and related regulatory compliance matters. Our Audit Committee meets with our independent registered public accounting firm on a quarterly basis to discuss its review of our interim financial information and, after our fiscal year-end, to discuss its audit of our annual consolidated financial statements, and its audit of intermal controls, including our procedures on internal control over financial reporting. Our Audit Committee also periodically meets in executive session (without the presence of management) with our independent registered public accounting firm to discuss any matters related to the audit of our annual consolidated financial statements and our internal control over financial reporting.

Compensation Risk Oversight. Our Compensation Committee reviews and oversees risk related to compensation of the Company’s employees, including NEOs and other key officers. We believe that our short- and long-term compensation structure properly incentivizes desired performance and discourages undesirable risk-taking.

Succession Planning

The Board is responsible for creating a succession plan for the Chief Executive Officer and other NEOs in the event of an emergency, retirement or otherwise. Our Nominating and Governance Committee has been delegated the responsibility of identifying, developing and evaluating potential executive position successors and periodically reports to the Board on such succession planning activities.

BOARD AND COMMITTEE MEETINGS

Board Meetings

The Board and its committees meet throughout the year and also hold special meetings and act by written consent from time to time. The Board of Directors met four times in 2022, including telephonic meetings, and acted three times by unanimous written consent.

The Corporate Governance Guidelines state that Board members are invited and generally expected to attend our annual meeting of stockholders and all of the directors attended the shareholder meeting in 2022 either in person or virtually.

Agendas and topics for Board and committee meetings are developed through discussions among management and members of the Board and its committees. Information and data that are important to the issues to be considered are distributed in advance of each meeting. Board meetings and background materials focus on key strategic, operational, financial, governance, risk and compliance matters applicable to us.

Controlled Company Status

Mr. Zalupski, our President, Chief Executive Officer and Chairman of the Board, holds more than a majority of the voting power of our common stock eligible to vote in the election of our directors. As a result, we are a “controlled company” within the meaning of the NYSE corporate governance standards. Under these corporate governance standards, a company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain NYSE corporate governance standards, including the requirements that (1) a majority of such company’s board of directors consist of independent directors, (2) such company’s board of directors have a compensation committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities, (3) such company’s board of directors have a nominating and governance committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities and (4) such company conduct an annual performance evaluation of the nominating and governance and compensation committees. We have elected to utilize certain of these exemptions. As a result, no committees of the Board, other than our Audit Committee, is composed entirely of independent directors. In addition, we have not conducted an annual performance evaluation of the nominating and governance and compensation committees during 2022. In the event that we cease to be a “controlled company” and shares of our common stock continue to be listed on NYSE, we will be required to comply with these provisions within the applicable transition periods.

Board Committees

The Board has three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. The Board may also establish special committees as necessary to address specific issues. Each of these committees reports to the Board as it deems appropriate and as the Board may request. The Board has adopted written charters for each of the committees, which are posted under the “Investor Relations—Governance—Documents & Charters” link on the Company’s website at www.dreamfindershomes.com. The information contained in, or that can be accessed through, our website is not incorporated by reference and is not a part of this Proxy Statement.

The Board does not currently have a lead director. The Board is comprised of capable and experienced independent directors and has a strong committee system (as described more fully below). We believe this leadership structure is appropriate for the Company and allows the Board to maintain effective oversight and management.

The table below sets forth the membership of the Board, its standing committees and the number of meetings held during 2022.

| | | | | | | | | | | | | | |

| Director Name | Board of Directors | Audit

Committee | Compensation Committee | Nominating and Governance Committee |

| Patrick O. Zalupski** | Chair | | | |

| William H. Walton III | X | | | |

| W. Radford Lovett II** | X | | Chair | X |

| Justin W. Udelhofen* | X | X | X | X |

| Megha H. Parekh | X | X | X | Chair |

| Leonard M. Sturm* | X | Chair | | X |

| William W. Weatherford | X | | | |

Number of 2022 meetings | 4 | 6 | 3 | 3 |

* Financial Expert ** Non-independent Director

| | |

Audit Committee

Our Audit Committee consists of Mr. Sturm, who serves as chair of the committee, Ms. Parekh and Mr. Udelhofen. The Board has determined that the members of our Audit Committee are independent for purposes of serving on such committee under the NYSE listing standards and applicable federal law, including Rule 10A-3 promulgated under the Exchange Act. In addition, the Board has determined that each current member of our Audit Committee is financially literate under the NYSE listing standards and that Mr. Sturm qualifies as an “audit committee financial expert,” as such term is defined in Item 407(d) of Regulation S-K.

Our Audit Committee operates pursuant to an Audit Committee Charter, which was approved and adopted by the Board and is posted under the “Investor Relations—Governance—Documents & Charters” link on the Company’s website at www.dreamfindershomes.com. The duties and responsibilities of our Audit Committee are set forth in its charter. Our Audit Committee is responsible for, among other matters:

•overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC and earnings press releases;

•appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm;

•delineating relationships between our independent registered public accounting firm and us and requesting information from our independent registered public accounting firm and management to determine the presence or absence of a conflict of interest;

•reviewing with our independent registered public accounting firm the scope and results of their audit;

•approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm;

•reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and our compliance with legal and regulatory requirements;

•establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters;

•reviewing and discussing with management cybersecurity, risk assessment and risk management and monitoring controls related to such exposures; and

•reviewing and approving related-person transactions.

Compensation Committee

Our Compensation Committee consists of Mr. Lovett, who serves as chair of the committee, Ms. Parekh and Mr. Udelhofen. Pursuant to our controlled company status, we have elected to utilize our exemption to the requirement that each of the members of our Compensation Committee be an independent director under the NYSE listing standards.

The Compensation Committee Charter has been posted under the “Investor Relations—Governance—Documents & Charters” link on the Company’s website at www.dreamfindershomes.com. The Compensation Committee Charter provides that our Compensation Committee is responsible for, among other matters:

•establishing the Company’s compensation programs and the compensation of the Company’s executive officers;

•monitoring incentive and equity-based compensation plans;

•reviewing and approving director compensation;

•reviewing and monitoring executive expense policies; and

•monitoring director and executive officer compliance with the stock ownership guidelines.

Nominating and Governance Committee

Our Nominating and Governance Committee consists of Ms. Parekh, who serves as chair of the committee, and Messrs. Lovett, Udelhofen and Sturm. Pursuant to our controlled company status, we have elected to utilize our exemption to the requirement that each of the members of our Nominating and Governance Committee be an independent director under the NYSE listing standards.

The Nominating and Governance Committee Charter has been posted under the “Investor Relations—Governance—Documents & Charters” link on the Company’s website at www.dreamfindershomes.com. The Nominating and Governance Committee’s primary purpose, as described in its charter, is to provide assistance to the Board in fulfilling its responsibility to our stockholders by: